Wholesale pricing is not a simple accounting exercise; it's a strategic pillar of your B2B channel management. An effective approach must protect your profitability while providing retail partners the margins they need to actively promote and sell your products. Get this balance right, and the result is stronger retailer adoption, enhanced brand equity, and sustainable market growth.

Why Your Wholesale Pricing Strategy Matters Commercially

It’s a common mistake to treat wholesale pricing as a cost-plus calculation: determine your cost of goods sold (COGS), add a desired profit, and set the price. This internal-only perspective misses the commercial reality. Your wholesale price is a powerful market signal that communicates your brand's value, defines the terms of your retail partnerships, and establishes the foundation for channel profitability.

The core challenge is finding the equilibrium between your financial requirements and your partners' needs. Price too high, and retailers lack the incentive to allocate valuable shelf space. Price too low, and you devalue your brand while leaving significant revenue on the table.

The Commercial Impact of a Coherent Price Point

A well-structured wholesale price is a strategic lever that directly influences critical business outcomes. It helps prevent channel conflict and builds a motivated network of distributors and retailers who advocate for your brand.

Consider the practical commercial impact:

- Retailer Adoption and Loyalty: A fair, predictable pricing structure makes you a preferred partner. Retailers are more likely to invest in co-marketing and grant premium placement to brands that offer consistent, healthy margins.

- Brand Perception and MAP Enforcement: Your wholesale price anchors your product's market value. Consistent pricing, often enforced through a Minimum Advertised Price (MAP) policy, maintains a premium brand image. In contrast, frequent, deep discounting can signal low quality or brand desperation.

- Market Stability: A sound pricing strategy prevents your retail partners from initiating a race to the bottom. This channel harmony creates a stable market, allowing everyone to focus on selling to the end consumer rather than competing against each other on price.

A thoughtful pricing strategy is your first line of defense against channel conflict. It ensures that both you and your partners have a clear path to profitability, turning a simple transaction into a sustainable business relationship.

Avoiding Common Pricing Pitfalls

Setting your price in a vacuum is a recipe for commercial failure. Without monitoring competitor pricing, you risk being undercut. Similarly, ignoring retailer feedback can lead to inventory stagnating on shelves.

Successful brands treat pricing as a dynamic process, not a "set it and forget it" task. They continuously analyze market data to ensure their strategy remains both competitive and profitable. This is where automated price monitoring tools become essential for providing the necessary market intelligence. For instance, a solution like Market Edge can track competitor pricing and reseller MAP compliance automatically.

Finding the Right Wholesale Pricing Model

Selecting a pricing model is a foundational decision for any wholesale program. The model you choose dictates your go-to-market strategy, influences retailer perception, and ultimately determines your profitability. The optimal choice aligns with your product, market position, and long-term commercial goals.

Most wholesale pricing strategies fall into three primary categories: Cost-Plus, Value-Based, and Tiered Pricing. Understanding their mechanics and applications is key to building a scalable B2B sales channel.

Cost-Plus Pricing: A Foundational Approach

Cost-Plus pricing is the most straightforward method. You calculate your total Cost of Goods Sold (COGS)—including materials, labor, and inbound shipping—and add a predetermined markup percentage to arrive at the wholesale price. Its primary advantages are simplicity and predictability.

This approach ensures that every sale covers direct costs and secures a consistent profit margin. It is a suitable starting point for companies selling standardized products or operating in markets where price is stable and availability is a key purchasing driver.

Mini Use Case:

A manufacturer of standard electrical wiring calculates that each spool costs $12.50 to produce and land in their warehouse. To achieve their target 40% gross margin, they add a markup. The calculation is Cost / (1 - Desired Margin), so $12.50 / (1 - 0.40) = $20.83. This becomes their wholesale price, guaranteeing profitability on every unit sold.

However, the simplicity of Cost-Plus is also its greatest weakness. It completely ignores external market factors, such as competitor pricing or customer perceived value. You might leave significant margin on the table if your product has high perceived value, or you could price yourself out of contention if your costs are higher than the market average.

Value-Based Pricing: Aligning Price with Perception

Value-Based pricing shifts the focus from internal costs to external customer value. The price is determined by the perceived value your product delivers to the retailer and their end customers. This is the preferred strategy for brands with unique intellectual property, a strong reputation, or innovative features that command a premium.

Executing this strategy requires a deep understanding of your market, customer needs, and competitive landscape. When implemented correctly, Value-Based pricing allows you to capture the maximum possible margin because the price is linked directly to the tangible benefits you provide.

Value-Based pricing detaches your price from your production cost. The central question is not "What did this cost to make?" but rather "What is this solution worth to our customer?"

Mini Use Case: A software company develops an inventory management tool that demonstrably reduces stock-outs for ecommerce retailers by 15%. Instead of pricing based on their low development overhead (a Cost-Plus approach), they price it based on the significant value it creates: increased sales, improved customer satisfaction, and better cash flow for their retail clients. The wholesale price reflects this high value, resulting in superior profit margins.

Tiered Pricing: Incentivizing Volume

Tiered pricing incentivizes larger order quantities by reducing the per-unit price as volume increases. It is an effective tool for moving inventory, improving cash flow, and rewarding high-volume retail partners. This model provides distributors with a clear financial motivation to consolidate their purchases and commit to your brand.

- Tier 1: 1-50 units at $20/unit

- Tier 2: 51-200 units at $18/unit

- Tier 3: 201+ units at $16/unit

The primary benefit is securing larger, more predictable revenue streams. The challenge lies in careful financial modeling. You must ensure that even the lowest-priced tier remains profitable and does not cannibalize sales from smaller accounts that would have otherwise paid a higher price.

Choosing Your Model: A Comparative Look

The right model depends entirely on your business context. You would not price a commodity component the same way you would price a patented medical device. This table summarizes the core differences to guide your decision.

Comparison of Wholesale Pricing Models

| Pricing Model | How It Works | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|---|

| Cost-Plus | Total Cost + Fixed Markup % | Standardized goods, commodity markets | Simple, predictable, ensures profit on every sale | Ignores market demand and competitor prices |

| Value-Based | Based on perceived customer value | Innovative products, strong brands | Maximizes potential profit margins | Requires deep market research and analysis |

| Tiered Pricing | Price per unit decreases with volume | Businesses wanting to incentivize bulk orders | Drives larger order sizes, improves cash flow | Can erode margins if tiers are not set carefully |

In practice, many businesses employ a hybrid approach. They might use Cost-Plus to establish a price floor that guarantees cost coverage, then layer on Value-Based principles and competitive data to optimize the final price. This is where automated competitor tracking tools become invaluable, providing the market visibility needed to make informed adjustments.

Nailing Down Your Foundational Wholesale Price

After selecting a pricing model, the next step is to calculate your foundational price. This number is not just an internal benchmark; it determines whether a retailer will stock your product. Getting this right is critical for building a profitable wholesale channel.

The process is a balancing act: you must cover all your costs, secure a healthy profit margin for your business, and leave enough margin for your retail partners to achieve their own return on investment. It's about creating a win-win scenario that motivates the entire supply chain.

The Standard Wholesale Margin: What Retailers Expect

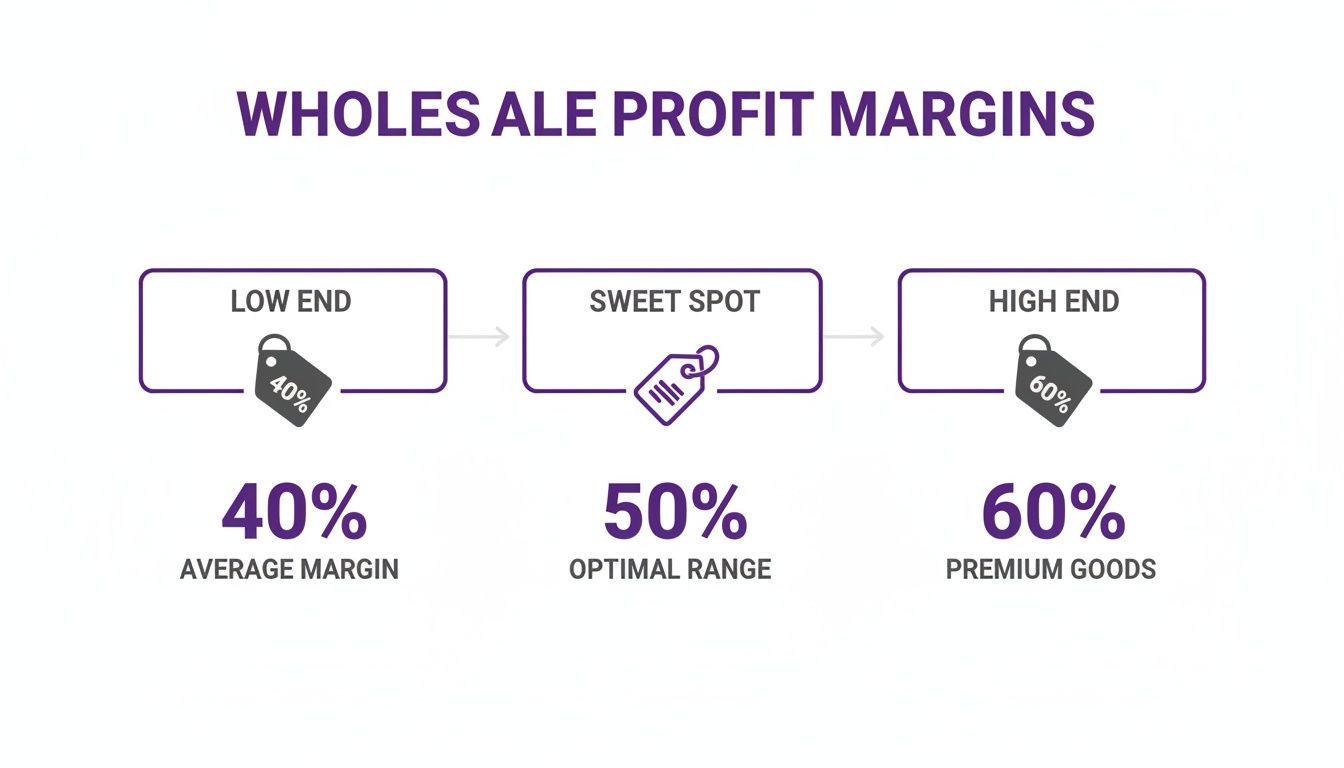

In the B2B landscape, there is an established benchmark for retailer margins. Typically, wholesale prices are set to allow for a 40% to 60% gross margin at the retail level. This range enables retailers to cover their operating costs (rent, staff, marketing) and earn a profit.

If your wholesale price compresses a retailer's margin below this band, your product becomes significantly less attractive, and they may refuse to carry it.

A common rule of thumb is the "keystone" price, where the wholesale price is 50% of the retail price. This simple 2x markup allows a retailer to set their shelf price by doubling your cost, securing them a 50% gross margin.

Failing to respect this industry standard will make it difficult to gain distribution and placement on retail shelves.

A Step-by-Step Guide to Calculating Your Price

Arriving at a competitive and sustainable wholesale price requires a methodical, data-driven approach. This process builds your price from the ground up, ensuring all costs are accounted for before profit is considered.

Here is a step-by-step process:

-

Calculate Your Total Cost of Goods Sold (COGS): This is the foundation of your pricing. Sum all direct costs associated with producing one unit: raw materials, factory labor, and inbound freight. For a deeper dive, see our guide on how to accurately calculate your cost of goods sold.

-

Add Your Profit Margin: Determine the gross profit margin your business needs to achieve on each unit. If your COGS is $10 and you require a 50% gross margin, your target wholesale price is $20 (calculated as

COGS / (1 - Desired Margin %)). -

Set the Suggested Retail Price (SRP): Work from your wholesale price to establish a realistic SRP. A $20 wholesale price with a standard keystone markup results in a $40 SRP. This provides your retail partner with the 50% margin they expect.

-

Conduct a Market Reality Check: This is the final validation step. How does a $40 SRP compare to similar products in the market? If you are priced significantly higher than competitors without clear justification, you may need to revisit your cost structure or accept a lower initial margin to gain market entry.

Practical Example:

A company manufactures premium leather wallets.

- COGS: The total cost for leather, labor, and packaging is $25 per wallet.

- Desired Margin: The brand targets a 60% margin to cover overhead, marketing, and profit.

- Wholesale Price Calculation:

$25 / (1 - 0.60) = $62.50. This is the price charged to retailers. - SRP Calculation:

$62.50 x 2 = $125. This is the intended retail price in stores.

Following a structured process like this ensures your wholesale prices are built on a solid financial foundation, protecting your profitability while providing clear value to your channel partners.

How Small Price Adjustments Drive Major Profit Gains

It's a common oversight to view wholesale pricing solely as a mechanism for covering costs and meeting a standard margin. This perspective misses one of the most powerful financial levers available to a business: profit leverage. Small, incremental improvements in realized price can generate a disproportionately large impact on operating profit.

This is a financial multiplier effect. Research consistently demonstrates that for most wholesale distributors, a 1% improvement in the average realized price—the final price after all discounts and rebates—can increase operating profit by 8-11%.

This occurs because most major business costs, such as rent, salaries, and marketing budgets, are fixed or semi-fixed. When you secure a slightly higher price for a product, that additional revenue is not needed to cover those fixed costs again. Consequently, nearly every dollar of that price increase flows directly to the bottom line.

This infographic illustrates the typical margin expectations that frame these pricing decisions.

Understanding this spectrum, from the 40% low end to the 60% high end, is crucial. It helps you identify opportunities to strategically increase prices without alienating retail partners, thereby dramatically improving your own profitability.

The Multiplier Effect in Action

Let’s examine the financial impact. Consider a distributor with the following simplified annual financials:

- Revenue: $10,000,000

- Cost of Goods Sold (COGS): $6,500,000

- Gross Profit: $3,500,000

- Operating Expenses (Fixed Costs): $2,500,000

- Operating Profit: $1,000,000

Now, assume the pricing team successfully increases the average realized price by just 1%.

A 1% price increase adds $100,000 to revenue (

$10,000,000 x 0.01). Since COGS and operating expenses remain constant, that entire $100,000 flows directly to operating profit.

The new operating profit becomes $1,100,000. This represents a 10% increase ($100,000 / $1,000,000) in total profitability from a seemingly minor adjustment. This calculation makes a clear business case for a sophisticated, data-driven approach to pricing.

Shifting from Reactive to Proactive Pricing

Understanding profit leverage should fundamentally alter your pricing philosophy. It is no longer a defensive exercise of setting a price and protecting it. Instead, it becomes a strategic search for small, justifiable price optimizations.

This is where modern technology provides a competitive advantage. Using sophisticated price optimization software in our detailed guide, you can identify specific products where you have a competitive edge or where the market can bear a slight price increase without affecting sales volume.

Rather than reactively offering discounts to close deals, a proactive strategy uses data to uncover hidden profit opportunities. You might discover that you can adjust prices for specific customer segments, geographic regions, or order sizes.

The key takeaway is that pursuing a 1% price improvement almost always delivers a higher return on investment than attempting to cut fixed costs by 1% or even increasing sales volume by 1%. It is the most direct path to a healthier bottom line. This is where automated tools like Market Edge become useful.

Protecting Your Pricing Strategy in the Real World

You have completed the analytical work: crunched the numbers, assessed the market, and developed a robust wholesale pricing strategy. However, a strategy is merely a plan until it is tested in the marketplace. The real challenge is not just setting the right price, but ensuring its integrity.

Without a robust price protection plan, even the most well-designed strategy can unravel. Price wars can erupt among your own retail partners, eroding your brand's value and compressing margins across the entire channel. Price protection requires constant, active governance.

The Problem with Manual Price Governance

For brands with more than a handful of retail partners, manually monitoring their pricing is an unwinnable effort. A sales manager cannot feasibly check dozens or hundreds of reseller websites and marketplaces like Amazon or eBay daily. The approach does not scale.

Manual monitoring presents several key roadblocks:

- Scale: The sheer volume of online sellers is overwhelming. By the time one price violation is identified, several more have likely appeared elsewhere.

- Lack of Evidence: Enforcing a pricing policy requires objective proof. Manual screenshots are inefficient, difficult to organize, and often lack the timestamped data needed to build a credible case with a reseller.

- Slow Reaction Time: Manual checks are inherently sporadic. A price violation can persist for days or weeks, allowing a rogue seller to undercut loyal partners and damage your brand's market value.

This reactive, firefighting mode consumes team resources and creates friction with the very partners you aim to support, putting your entire channel strategy at risk.

Enforcing MAP and RRP Policies

This is where policies like Minimum Advertised Price (MAP) and Recommended Retail Price (RRP) become critical. These are the standard tools for creating price consistency in the market. Such agreements establish the lowest price a retailer can advertise for your product, which protects its perceived value and ensures a level playing field for all sellers.

However, a policy is only as effective as its enforcement. When one seller violates your MAP policy, it can trigger a domino effect as other retailers lower their prices to remain competitive, leading to a race to the bottom that benefits no one.

Consistent MAP enforcement is not about punishing partners; it's about protecting the entire retail ecosystem. It signals to your best retailers that you are committed to defending their margins and the long-term health of your brand.

Effective enforcement requires a systematic process for identifying violations, communicating with non-compliant sellers, and escalating consequences as needed. Without this structure, your policies are merely suggestions.

The Role of Automated Price Monitoring

Automated monitoring platforms are now a non-negotiable tool for modern brands. These solutions act as your eyes and ears in the market, operating 24/7 to scan the web and ensure your pricing policies are being respected.

A robust, vendor-neutral price monitoring tool performs several critical functions:

- Continuous Tracking: It automatically crawls reseller websites and major marketplaces, collecting price and stock data for your SKUs around the clock.

- Instant Violation Alerts: The moment a price falls below your established MAP or RRP, the platform flags it and sends an immediate alert to your team.

- Automated Evidence Capture: Every violation is documented with screenshots and timestamps, creating an undeniable record for use in discussions with retailers.

- Unauthorized Seller Detection: Advanced systems can identify sellers who are not authorized to carry your product, helping you combat gray market activity that disrupts your pricing structure.

By automating the tedious work of data collection, these platforms enable your team to shift from problem-hunting to problem-solving. This is where a dedicated tool like Market Edge can make all the difference.

Your Actionable Wholesale Pricing Checklist

Translating strategy into practice requires a clear, step-by-step plan. This checklist serves as a roadmap for implementing a profitable wholesale program. Whether you are refining an existing strategy or building one from the ground up, these steps will provide structure.

Phase 1: Laying the Groundwork

Before calculating any numbers, you must align your pricing strategy with broader business objectives. A price without a strategic purpose is merely a number.

- Define Your Primary Goal: What is the number one objective for your wholesale channel? Is it rapid market share acquisition, profit maximization, or positioning as a premium brand? Your answer will guide all subsequent decisions.

- Establish Your Cost Baseline: Calculate your true Cost of Goods Sold (COGS) for every product. This includes all direct costs: raw materials, labor, inbound shipping, packaging, and duties. This figure is your absolute price floor.

- Analyze the Competitive Landscape: Identify your top three direct competitors and research their retail pricing. You can then work backward to estimate their wholesale prices, providing a critical market benchmark.

Phase 2: Choosing Your Model and Doing the Math

With a solid foundation, you can now build the pricing mechanics. This involves selecting the right model and calculating your initial price list.

- Select Your Pricing Model: Choose a strategy based on your goals and product type. Cost-Plus is suitable for standardized goods. Value-Based is ideal for innovative products with strong brand equity. Tiered pricing works well for incentivizing bulk orders.

- Calculate the Wholesale Price: Start with your COGS and apply your target profit margin. For a COGS of $50 and a desired 50% margin, the wholesale price is $100. The formula is

Cost / (1 - Margin Percentage). - Set the Suggested Retail Price (SRP): The keystone model (a 2x markup) is a reliable starting point. A $100 wholesale price yields a $200 SRP, providing your retail partners with a standard 50% margin.

- Perform a Reality Check: Step back and evaluate your SRP. How does it compare to competitors? Does it align with your brand's perceived value? Be prepared to adjust your margins to find the optimal balance between profitability and market acceptance.

Phase 3: Setting the Rules and Keeping Watch

A pricing strategy is only as strong as your ability to enforce it. This final phase involves creating the systems and policies to protect your brand's integrity in the market.

A pricing policy without active monitoring is just a suggestion. Consistent enforcement protects your brand's value and shows your best retail partners you've got their back.

- Document Your Official Pricing Policy: Create a formal document that outlines your wholesale prices, SRP, and discount tiers. Crucially, establish a clear Minimum Advertised Price (MAP) policy that details the rules and consequences for non-compliance.

- Implement a Monitoring System: Manual price checking is not scalable. You need an automated solution for monitoring compliance. This is where a price monitoring tool like Market Edge provides significant value by automating this process.

- Define Your Enforcement Protocol: What happens when you find a violation? Map out the exact steps, from an initial warning email to a final notice of account suspension. Consistency is key to fair and effective enforcement.

Answering Your Top Wholesale Pricing Questions

As you implement your wholesale pricing strategy, several common questions will arise. Here are answers to some of the most frequent challenges faced by B2B decision-makers.

How Often Should I Review My Wholesale Prices?

As a general rule, a comprehensive review of your wholesale pricing should occur at least annually. A quarterly review is advisable for businesses in fast-moving industries. This cadence allows you to remain responsive to market shifts without causing disruption for your retail partners.

However, certain events should trigger an immediate pricing review:

- Significant Cost Increases: If your COGS rises by more than 5% due to material or freight costs, a price adjustment may be necessary.

- Major Competitor Actions: When a direct competitor implements a significant price change, you must analyze its impact on your market position.

- New Product Launches: Introducing a new product provides a natural opportunity to review the pricing of your entire portfolio for consistency.

What Is the Best Way to Handle Discount Requests?

Large retail partners will inevitably request discounts. The key is to avoid ad-hoc price reductions that erode your margins. Instead, reframe the negotiation as a value exchange.

Offer a price reduction in return for a tangible commitment from the retailer. For example, you could provide a 5% discount in exchange for a larger order volume, premium in-store placement, or inclusion in a major promotional campaign. This approach turns a price concession into a mutually beneficial strategic investment.

Never give a discount without getting something in return. Frame it as a mutual investment, not a concession.

How Do I Set a Wholesale Price for a New Product?

Pricing a new product involves both quantitative analysis and strategic judgment. Start with the data: calculate your COGS to establish your absolute price floor.

Next, conduct market research to determine the retail price range for comparable products. This provides a benchmark for market expectations. Finally, consider your brand positioning: are you a premium, value, or mid-market option?

For example, if your COGS is $10 and competing products retail for $40-$50, setting your wholesale price at $22 (which suggests a $44 SRP) would be a data-informed starting point.

After launch, it is crucial to monitor market reaction and competitive response. This is where automated competitor tracking solutions like Market Edge provide the intelligence needed to validate your initial strategy and make agile adjustments.

Ready to protect your brand and margins? See how Market Edge delivers the competitive intelligence you need to master your wholesale pricing strategies. Learn more about mastering your wholesale pricing.