Instead of building a product and then deciding how much to charge, you start with the price you know the market will accept. Then, you work backward to engineer a product that can be sold profitably at that price. This is the core principle of target pricing.

It's a market-first strategy that flips the traditional cost-plus model on its head, forcing a level of discipline that drives both market share and profitability.

Understanding Target Pricing and Why It Matters Commercially

At its core, target pricing means letting market realities—not internal costs—drive product development and business strategy. You stop asking, "What did this cost to make, and what's our markup?" Instead, the critical question becomes, "To be profitable at the price customers are willing to pay, what must our costs be?"

This shift is critical for B2B decision-makers. It forces teams across product, procurement, and sales to align on a single goal: capturing market share without sacrificing margins.

The Commercial Importance of Market-First Pricing

In competitive B2B and ecommerce environments, a cost-plus model is a significant liability. You either price your product too high for the market, killing sales velocity, or price it too low and leave margin on the table.

Target pricing directly addresses these risks by anchoring the entire product lifecycle to a validated market price. The commercial benefits for managers and business owners are clear:

- Improved Competitiveness: Products are launched at a price point that is already proven to work in the market.

- Enhanced Profitability: The strategy enforces strict cost discipline, protecting target profit margins from the outset.

- Greater Market Alignment: Product development focuses on delivering features customers value at a price they will pay, reducing wasted R&D.

- Stronger Supplier Negotiations: Procurement teams enter negotiations with a non-negotiable target cost, giving them significant leverage.

Target pricing elevates pricing from a final calculation to a foundational element of your business strategy. It's less about finding a price and more about engineering a profitable product to fit a specific price window.

This market-driven approach is closely related to other customer-centric strategies. To understand how customer perception can reshape your pricing model, see our guide on value-based pricing.

Implementing this strategy effectively requires accurate, real-time market data. This is where automated price monitoring tools like Market Edge become useful, providing the intelligence needed to set a viable target price.

The Three Pillars of a Target Pricing Framework

Effective target pricing is a disciplined process, not a guess. It’s built on three core components calculated in a specific, non-negotiable order. If one pillar is weak, the entire strategy fails.

First, establish the Target Price. This is the ceiling set by the market—the price point customers are willing to pay for your product, given the competitive landscape. Determining this number requires objective analysis of competitor pricing, customer value perception, and your brand's market position.

Next, define the Target Profit. This is the required profit margin your business needs to achieve its financial objectives. It's a strategic internal decision based on stakeholder expectations, industry benchmarks, and reinvestment goals.

Finally, you derive the most critical component: the Target Cost.

Calculating Your Target Cost

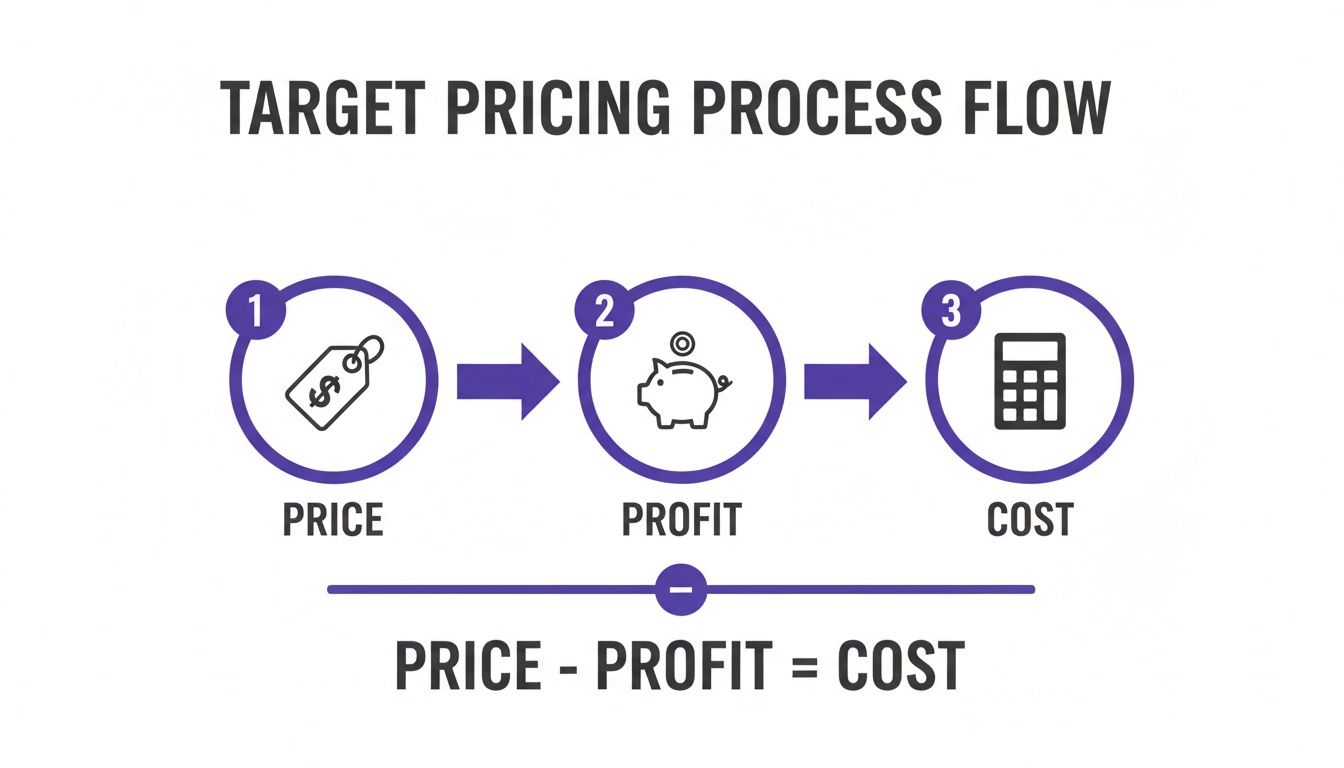

This final pillar is not an estimate; it's the direct result of the first two. The formula is simple but its impact is profound:

Target Price - Target Profit = Target Cost

This is not a guideline for your teams; it's a hard limit. This calculated Target Cost becomes the primary constraint for product design, engineering, and procurement. The entire conversation shifts from, "What will it cost to make this?" to "How do we design and source this product to meet our target cost?"

Why the Order Is Everything

If you reverse the sequence, the strategy collapses into a cost-plus model. The power of the framework lies entirely in its market-first approach.

- Pillar 1: Target Price: Dictated by the market. Setting this accurately requires continuous competitor tracking. Without real-time data from tools that monitor online marketplaces and retailers, your starting point is fundamentally flawed.

- Pillar 2: Target Profit: A purely internal business decision. It defines what a "win" looks like for the product long before production begins.

- Pillar 3: Target Cost: The challenge given to your internal teams. It forces innovation and ruthless efficiency at every step of the value chain.

Following this structure turns pricing from an operational task into the foundation of your product strategy. Vendor-neutral platforms like Market Edge provide the accurate, up-to-the-minute competitor data required to set a realistic and powerful Target Price.

A Step-by-Step Guide to Implementing Target Pricing

Putting target pricing into action is a disciplined workflow that aligns market research, finance, and product engineering around a single, market-driven number. Instead of starting with internal costs, you start with the market price and work backward.

The formula is your guide: determine the price the market will bear, subtract your required profit margin, and the remainder is the absolute maximum your product can cost to produce.

This simple equation makes the market price and your profit margin fixed goals, forcing your teams to innovate on cost management.

1. Establish an Evidence-Based Target Price

This first step is the most critical. You must determine the price the market will actually sustain, and guesswork is not an option. This requires objective data.

- Competitor Tracking: Continuously monitor what direct and indirect competitors are charging for similar products across all channels. Identify price leaders and their strategies.

- Customer Analysis: Use surveys, focus groups, or conjoint analysis to quantify which features customers value most and what price points they perceive as fair.

- Market Positioning: Objectively assess where your product fits. Are you a premium, value, or budget offering? Your target price must align with this position.

2. Define Your Required Profit Margin

With a realistic target price established, the next step is internal. Decide on the profit margin the business requires to meet its financial goals. This is a strategic, non-negotiable figure based on your P&L, stakeholder expectations, and long-term strategy.

3. Calculate Your Allowable Target Cost

With the target price and required margin locked in, the calculation is simple:

Target Price − Required Profit Margin = Target Cost

This number becomes the primary directive for your product development, engineering, and supply chain teams. It is the cost ceiling for everything from raw materials to labor. For a deeper look at these expenses, see our guide on the cost of goods sold.

4. Engineer the Product to Meet the Cost

This is where the strategy is executed. Your teams are now challenged to build a product that meets market expectations within a strict budget, without sacrificing the quality that justifies the target price. Success depends on:

- Value Engineering: Analyzing every component and process to eliminate costs that do not add perceptible value for the customer.

- Supplier Negotiations: Using the fixed target cost as leverage to secure better pricing from suppliers.

- Process Optimization: Improving manufacturing, assembly, and logistics to reduce overhead.

5. Monitor and Adjust Continuously

Markets are dynamic. Competitors change prices, supply chain costs fluctuate, and customer preferences evolve. A "set it and forget it" approach will fail. You need a system for continuous market monitoring to ensure your target price remains competitive and your cost assumptions remain valid. This is where automated price monitoring and MAP enforcement tools prove their value, providing the ongoing intelligence needed to protect your strategy.

How Target Pricing Changed the Game for the Auto Industry

To see the strategic power of target pricing, look at the automotive industry. For decades, American automakers operated on a cost-plus model. They designed a car, calculated production costs, added a profit margin, and set the price. This worked when competition was limited.

Everything changed in the 1980s when Japanese manufacturers like Toyota entered the North American market. They didn't just bring more efficient cars; they brought a fundamentally different business philosophy. Instead of building a car and then pricing it, they started with the price they knew American consumers were willing to pay.

A Market-First Competitive Weapon

This approach flipped the traditional model entirely. Toyota’s leadership didn't ask, "How much will this car cost to build?" Their question was, "How can we build a car that meets market expectations and our profit goals for under $12,800?"

That question demanded a level of innovation and discipline their competitors were unprepared for.

Every department—from design and engineering to supply chain and manufacturing—was focused on one mission: hit the target cost without compromising the quality that would win over American consumers. This was not just an accounting exercise; it was a competitive strategy.

By anchoring every decision to a market-driven price, Toyota turned cost management into a strategic advantage. It forced the entire product development process to align with delivering superior customer value at a profitable price point.

Target pricing was the engine behind their market capture strategy. When planning a new midsize car in the mid-1980s, Toyota determined the market could bear a price around $16,000. After setting a 20% target profit margin, they arrived at a non-negotiable target cost of $12,800—a figure that was reportedly over 30% below initial engineering estimates.

This forced relentless efficiency, leading to the launch of the Camry at an aggressive price. The result? Toyota’s market share in the U.S. sedan market more than doubled by 1990. You can explore how this pricing strategy works at Business Case Studies.

Lessons for Today's Ecommerce and B2B Leaders

This history offers a critical lesson for today's digital marketplaces. Basing your prices on internal costs is a defensive posture that makes you vulnerable to market shifts. Understanding what is target pricing allows you to operate from a position of strength.

Executing this requires robust market intelligence to set the right target price. This is where automated price monitoring tools like Market Edge are essential. They deliver the real-time competitor data needed to set an ambitious yet achievable target, forming the foundation of a winning market-first strategy.

Powering Your Strategy With Modern Pricing Intelligence

While the principles of target pricing are timeless, executing it in today's fast-paced ecommerce environment without modern technology is nearly impossible. Manually tracking competitor prices across thousands of SKUs on marketplaces like Amazon is an obsolete practice. By the time the data is compiled, it's already out of date.

The Need for Real-Time Market Data

For your Target Price to be a strategic asset rather than a guess, it must be informed by accurate, real-time market intelligence. This is the primary function of automated competitor price monitoring tools. They provide the continuous data stream needed to set prices with confidence.

Without this intelligence, your target price is an assumption. With it, your price is a data-driven decision that provides a competitive edge. This is what modern pricing analysis software is designed to deliver.

Enforcing Price and Protecting Profit

Technology is not just for setting the initial price; it is critical for protecting your Target Profit and brand value post-launch.

- MAP/RRP Enforcement: For brands selling through distributors or online retailers, protecting your price is crucial. Automated tools can monitor your entire retail channel for MAP (Minimum Advertised Price) violations 24/7, preventing unauthorized discounting that erodes margins and damages your brand's perceived value.

- Channel Conflict Resolution: By instantly identifying sellers who violate pricing agreements, you can resolve channel conflicts swiftly and maintain a level playing field for your authorized partners.

A successful target pricing strategy relies on a continuous feedback loop. You set the price based on market data, then you monitor the market to ensure that price holds and your profits are protected.

This is where a vendor-neutral pricing intelligence platform demonstrates its value. A solution like Market Edge, for example, uses AI to accurately match products and deliver clean, actionable data. This helps B2B leaders not only set a precise target price but also enforce the MAP policies needed to protect their target profit, turning a complex manual process into an automated, strategic advantage.

Your Actionable Target pricing Checklist

Moving from theory to execution requires a clear plan. Here is a straightforward checklist to launch your first target pricing initiative. This workflow ensures alignment across marketing, finance, and operations from the start.

Phase 1: Market Intelligence Gathering

Before analyzing internal numbers, you must understand the external competitive landscape.

- Identify Key Competitors: List the top 3-5 direct competitors for a specific product line.

- Track Pricing and Promotions: Systematically monitor their current prices, discount frequency, and any public MAP/RRP policies. Manually attempting this is inefficient; automated competitor tracking tools are essential for accuracy and scale.

Phase 2: Internal Goal Setting

With a clear view of the market, define what success looks like for your business.

- Define Your Required Profit Margin: Determine the non-negotiable gross profit margin required for this product line to meet company financial goals.

- Calculate Your Target Cost: Apply the core formula: Target Price - Target Profit = Target Cost. This number is the budget constraint for your product, procurement, and engineering teams.

Phase 3: Cross-Functional Execution

With market data and internal goals established, align your teams to execute the plan. The mission is to hit the target cost without compromising the quality that justifies the target price.

- Conduct a Cost-Reduction Workshop: Bring together leaders from product development, engineering, and procurement.

- Brainstorm Actionable Solutions: Challenge the team to identify concrete cost-saving measures. Can a component be value-engineered? Can a supplier contract be renegotiated? Can a manufacturing process be optimized? This is where innovation is driven by financial constraints.

The entire process is amplified by real-time data. This is where automated price monitoring tools like Market Edge deliver significant value, providing the live market insights your teams need to make informed, profitable decisions.

Your Top Target Pricing Questions, Answered

Here are clear answers to common questions about how target pricing compares to other models and the key risks involved.

How Is Target Pricing Different From Value-Based Pricing?

While both are market-oriented, they start from different questions.

Value-based pricing seeks to quantify the economic value a product delivers to a customer. The price is set based on this perceived worth (e.g., "This software saves our customer $10,000 a year, so we can charge $2,000").

Target pricing is grounded in competitive reality. It analyzes what similar products are currently selling for and determines the price customers are willing to pay within that specific market environment.

In short, value-based pricing sets a ceiling based on customer ROI, while target pricing sets a practical ceiling based on market competition and price sensitivity.

What Are The Biggest Pitfalls To Avoid?

The most common failure is treating the target cost as a soft guideline instead of a hard limit. Once product teams exceed the cost ceiling, the model breaks down and reverts to a less profitable cost-plus approach.

The second major pitfall is basing the strategy on poor data. If your initial target price is derived from outdated or incomplete market intelligence, the entire strategy is built on a flawed foundation. A wrong price leads to a wrong cost, putting the product at a commercial disadvantage from day one.

The discipline required pays significant dividends.

A landmark study found that firms properly implementing target pricing achieved 35% higher profitability than peers using cost-plus methods. They also reduced product development costs by an average of 28%, demonstrating that a well-executed strategy improves both top-line revenue and bottom-line efficiency. You can read more about these pricing study findings on Indeed.com.

To avoid these pitfalls, a real-time, accurate view of the market is non-negotiable. This is where automated tools like Market Edge become useful, providing the competitor intelligence needed to build a winning strategy from the start.