Finding a wholesale supplier is less of a sourcing task and more of a foundational business decision. These partners are the bedrock of your profit margins, the guardians of your stock levels, and a crucial component of your brand's reputation. A poor choice leads to stockouts, dissatisfied customers, and a direct impact on profitability.

This guide provides a practical framework for finding, vetting, and managing wholesale partners who can support—not hinder—your growth.

Why Finding the Right Supplier Is a Strategic Imperative

For B2B decision-makers, the search for wholesale suppliers is a strategic move that directly impacts scalability. The objective isn't just to secure the lowest cost per unit, but to build a resilient supply chain—a partnership—that enables growth. An effective supplier relationship is a significant competitive advantage.

The Commercial Impact of Your Supplier Choice

The supplier you select has cascading effects across your entire operation, influencing inventory management, pricing strategy, and brand perception. A reliable partner ensures you can consistently meet customer demand, building trust and encouraging repeat business. Stockouts don't just represent a lost sale; they damage your reputation and can even harm search rankings on competitive marketplaces.

Furthermore, a supplier's approach to pricing is critical. Partners must understand and respect your MAP/RRP policies to prevent price wars that erode margins and devalue your brand. The goal is to create a stable, profitable ecosystem for your products, regardless of the sales channel.

Use Case: An electronics brand struggled with unauthorized resellers on Amazon constantly undercutting their MSRP. By switching to a supplier that actively enforced a strict MAP policy, they stabilized their online pricing within 60 days, leading to a 15% improvement in profit margins for their authorized retail partners and a reduction in channel conflict.

The Growing Importance of Digital Integration

A supplier's technological capabilities are as important as their product catalog. Relying on partners who use manual processes for inventory and order management is a recipe for inefficiency and costly errors. Your business requires suppliers whose systems can integrate seamlessly with yours.

This digital divide is a key factor in wholesale distribution performance. Currently, only 42% of wholesalers have fully adopted modern ERP or e-commerce systems. However, those that have report 24% better inventory turnover and 30% higher order accuracy. For more detail, see these wholesale industry challenges on reesmarx.com. This performance gap underscores the importance of prioritizing suppliers with robust digital infrastructures.

A supplier that provides real-time inventory data via an API is no longer a luxury; it is a necessity for preventing stockouts and automating reordering processes.

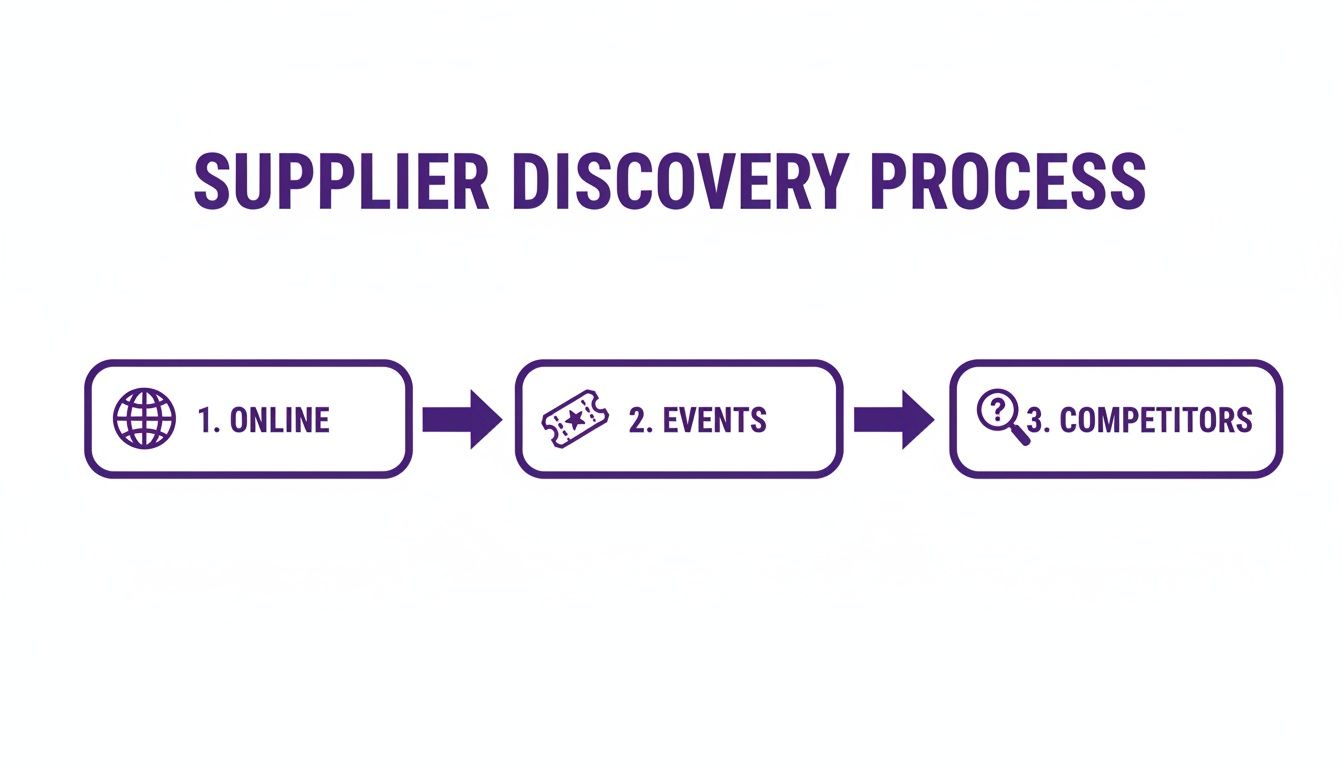

Where to Discover Your Next Wholesale Partner

Identifying the right wholesale partner requires a methodical approach that combines digital platforms with traditional industry channels. The global wholesale market is projected to reach USD 73.13 trillion by 2029, growing at 6.1% annually. This growth means a vast number of potential partners, making a targeted discovery strategy essential. To understand the drivers behind this expansion, explore the trends shaping the wholesale distribution market on insitusales.com.

Navigating B2B Marketplaces and Directories

Online B2B marketplaces are the logical starting point, offering powerful search tools to filter thousands of manufacturers and distributors.

Focus your efforts on two primary types:

- Global Marketplaces: Platforms like Alibaba and Global Sources connect you with a vast network of international manufacturers. They are ideal for high-volume orders but require thorough due diligence.

- Niche and Regional Directories: Services like Wholesale Central or other specialized trade portals often list pre-vetted domestic suppliers. These can be advantageous for faster shipping or testing new product lines with a lower Minimum Order Quantity (MOQ).

When using these platforms, look for suppliers with "Verified" or "Gold Supplier" designations. While not a definitive guarantee of quality, it indicates the platform has performed a basic verification of their business registration, adding a useful layer of security. Use platform filters to move beyond broad searches and identify specialists in your exact product category.

The Strategic Value of Trade Shows and Events

While digital sourcing is efficient, industry trade shows remain a powerful channel for building strong supplier relationships. These events bring manufacturers, distributors, and brand representatives together, offering unique advantages.

Attending a trade show allows you to:

- Evaluate Product Quality Firsthand: Physically inspect products, ask detailed technical questions, and assess craftsmanship in a way that is impossible online.

- Negotiate Directly with Decision-Makers: Engage with sales leaders or company founders, accelerating negotiations and securing more favorable terms.

- Discover Exclusive or Emerging Brands: Gain early access to new product launches, positioning your business as a key partner before competitors are aware of new market trends.

To maximize the value of a trade show, pre-schedule meetings with high-priority suppliers. Arrive with a clear agenda covering production capacity, MAP policy enforcement, and data integration capabilities.

Uncovering Suppliers Through Competitor Analysis

One of the most effective methods for finding qualified suppliers is to identify who your successful competitors use. They have already invested the resources to vet and establish relationships with reliable partners.

This requires strategic analysis. Use trade data services to review import records or analyze competitor product catalogs for brand overlaps that indicate a shared distributor. This approach provides a pre-vetted list of potential suppliers who are already proven in your market.

Competitor monitoring thus becomes a strategic sourcing tool. Tracking the brands and products your rivals carry generates a direct pipeline of supplier leads. This is where automated price monitoring tools like Market Edge become useful, allowing you to monitor competitor assortments at scale and flag new supplier opportunities as they emerge.

Comparison of Supplier Sourcing Channels

This table provides a breakdown of the primary sourcing channels to help you select the optimal approach based on your specific business requirements.

| Sourcing Channel | Best For | Key Advantages | Potential Challenges |

|---|---|---|---|

| B2B Marketplaces | High-volume sourcing, finding international manufacturers, broad product searches. | Massive selection, powerful search filters, competitive pricing. | Quality control issues, communication barriers, long lead times. |

| Trade Shows | Building relationships, evaluating product quality firsthand, discovering new trends. | Face-to-face interaction, direct negotiation, immediate product feedback. | High cost (travel, tickets), time-intensive, requires pre-planning. |

| Directories | Finding pre-vetted domestic or niche suppliers, smaller order quantities. | Vetted lists, lower MOQs, faster shipping times for domestic partners. | Smaller selection than large marketplaces, may have higher unit costs. |

| Competitor Analysis | Identifying proven suppliers in your specific market, shortening the vetting process. | Access to pre-vetted partners, market-validated products and brands. | Requires research tools, potential for supplier exclusivity issues. |

The most effective strategy often involves a blended approach. Begin with broad searches on marketplaces to understand the landscape, then leverage trade shows and competitor analysis to identify high-quality partners.

A Vetting Framework to Separate Partners from Pitfalls

A list of potential suppliers is only the first step. The vetting process is where you mitigate risk and determine which partners can support a profitable, long-term business. A disciplined framework is essential to distinguish strategic partners from low-cost liabilities.

Your initial supplier discovery likely involved online research, industry events, or competitor analysis.

Each of these paths leads to the critical phase of asking targeted questions to build a reliable shortlist.

Assessing Operational and Financial Stability

Before evaluating product quality or price, confirm a potential partner's operational reliability. Their internal processes for order management, payments, and production form the foundation of the relationship.

Begin with these non-negotiable checks:

- Minimum Order Quantities (MOQs): Determine their minimum order requirements, both in units and total cost. An excessively high MOQ can strain capital by tying it up in slow-moving inventory.

- Production Lead Times: Clarify the exact turnaround time from purchase order submission to goods shipment. Vague or lengthy timelines are a significant red flag for potential stockouts.

- Payment Terms: Inquire about available payment terms, such as Net 30 or Net 60. Flexible terms are critical for effective cash flow management as your business scales.

- Trade References: Request and contact references. A reputable supplier will readily provide contacts for satisfied customers. Hesitation to do so is a warning sign.

A supplier offering a low unit price but requiring a $20,000 MOQ with a 90-day lead time is a poor fit for an agile ecommerce business that must respond quickly to market shifts.

Evaluating Technological Maturity

A supplier's technology stack is a key indicator of its efficiency and scalability. Manual processes create bottlenecks that will ultimately impede your operations. A partner's systems must be able to integrate with yours.

Key questions to ask include:

- Inventory Data Access: Can they provide real-time or near-real-time inventory data via an API or automated feed? This is a critical requirement for any brand serious about preventing stockouts.

- Order Placement Process: Is their ordering system automated, or does it rely on manual methods like email and spreadsheets? An integrated system reduces administrative overhead and minimizes human error.

- Product Information Management (PIM): How do they manage and distribute product data, including specifications, descriptions, and high-resolution imagery? A supplier with a robust PIM system simplifies the process of listing and marketing their products.

If a supplier's inventory update process consists of a weekly spreadsheet, they represent a significant operational risk. For more on using data effectively, our guide on competitive intelligence gathering offers valuable insights.

The objective is to find a partner whose systems can interface directly with yours. A supplier with a modern API is not just a vendor; they are an extension of your operational workflow.

Gauging Commitment to Brand and Price Integrity

A supplier's responsibility extends beyond shipment. Their commitment to protecting your brand's value and maintaining price stability is crucial, particularly if you operate within a reseller network.

Clarify their pricing policies:

- MAP/RRP Policy Enforcement: Do they have a Minimum Advertised Price (MAP) or Recommended Retail Price (RRP) policy? Crucially, do they enforce it? Request a copy of their policy and inquire about their process for handling violators.

- Distribution Controls: How do they vet their retail partners? Uncontrolled distribution leads to market saturation and unauthorized sellers on platforms like Amazon and eBay, which will destroy your margins.

A supplier that fails to enforce its own pricing policies permits other sellers to erode your profitability. Automated tools can monitor your products across the web, ensuring all partners adhere to pricing agreements. This protects your margins and the long-term equity of your brand.

How to Negotiate Terms That Fuel Your Growth

Effective negotiation is not about winning a confrontation but about building a sustainable partnership. The terms you establish will define your profitability and supply chain stability for years to come. The goal is to create a strategic alliance where both parties are invested in mutual success.

Crafting Your First Outreach

A professional, well-researched initial email is critical. Avoid generic templates and demonstrate that you have researched their brand and understand their market position. This immediately distinguishes you from low-effort inquiries.

Here is a clear, professional template to adapt:

Subject: Partnership Inquiry from [Your Company Name]

Dear [Supplier Contact Name],

My name is [Your Name], and I am the [Your Title] at [Your Company Name]. We are a [brief description of your business, e.g., a B2B distributor specializing in premium home goods] serving customers across [Your Market].

We have been impressed with the quality and market reputation of [Mention a Specific Product Line] and believe your products are an excellent fit for our customer base.

We are interested in opening a wholesale account and would appreciate it if you could provide details on your partnership program, including your product catalog, pricing structure, and MAP policy.

Thank you for your time. We look forward to the possibility of working together.

Best regards,

[Your Name]

This approach is direct, respectful, and establishes your credibility as a serious business.

Key Negotiation Points to Protect Your Margins

Once contact is established, focus on the commercial terms that will most significantly impact your cash flow and profitability. Their initial offer is a starting point for negotiation.

- Tiered Volume Pricing: Instead of a single wholesale price, negotiate a tiered structure where the unit cost decreases as your order volume increases. This creates a built-in incentive for growth.

- Exclusivity Rights: Inquire about regional or channel exclusivity. Securing the sole right to sell a product in a specific territory or on a marketplace like Amazon can create a powerful competitive advantage.

- Favorable Payment Terms: Negotiate for Net 30 or Net 60 payment terms. This provides a crucial window to sell inventory before payment is due, significantly easing pressure on your cash flow. Our deep dive on how to negotiate with suppliers offers more advanced tactics.

Real-World Example: Strategic Negotiation in Practice

An ecommerce brand selling high-performance athletic gear moved beyond simple unit cost negotiation. They focused on building a partnership that would protect brand integrity and margins across all sales channels.

They secured two critical terms:

- Co-Op Marketing Funds: The supplier agreed to contribute a percentage of the brand's total spend into a co-op marketing fund. This created a shared budget for joint advertising campaigns, increasing visibility for both companies.

- Strict MAP Enforcement: The brand obtained a contractual commitment that the supplier would actively enforce its MAP policy, including specific penalties for violations and a clear process for reporting unauthorized sellers.

This strategic approach prevented price erosion and maintained a stable, profitable market. It demonstrates how reseller monitoring is not just a reactive measure but a proactive strategy that should be integrated into supplier agreements. This is where automated monitoring solutions provide the data necessary to hold partners accountable.

Onboarding and Monitoring: Where the Real Work Begins

Securing a supplier agreement is the starting line, not the finish. Effective onboarding and diligent, ongoing monitoring are what transform a contract into a resilient supply chain. Neglecting these steps leads to incorrect product data, unexpected stockouts, and operational friction.

Onboarding is the process of integrating a new supplier into your company's operational workflow. It must be seamless.

A Practical Onboarding Checklist

A structured checklist ensures that systems, people, and processes are aligned from day one.

Your onboarding process must include:

- System Integration: Establish a reliable method for receiving product data, including SKUs, descriptions, images, and real-time inventory levels. This data feed must integrate directly with your PIM or ecommerce platform to eliminate manual entry and reduce errors.

- Communication Protocols: Define clear points of contact for logistics, purchase orders, and accounting. Establishing these channels upfront prevents confusion and delays when issues arise.

- Order and Fulfillment Cadence: Map the entire order lifecycle. Confirm lead times, purchase order submission procedures, shipping notification processes, and protocols for handling returns or damaged goods.

- Compliance and Policy Alignment: Ensure your new partner receives and acknowledges your key policies in writing, particularly regarding MAP/RRP enforcement. They must understand your expectations for how their other customers will price your products.

A supplier's performance during onboarding is a strong indicator of their future operational competence. Difficulties in providing clean data feeds or establishing clear communication are significant red flags.

Why You Can’t “Set It and Forget It”

The supplier relationship requires continuous oversight. The U.S. wholesale distribution industry is projected to see 4.6% revenue growth in 2025, driven by investments in automation and efficiency. In this dynamic environment, a supplier's ability to provide real-time data is essential for maintaining a competitive edge. You can explore these wholesale distribution trends on MDM.com.

Key Areas for Ongoing Supplier Monitoring

Ongoing monitoring should focus on two areas that directly impact your bottom line: supply chain stability and brand integrity.

1. Supply Chain Health and Performance

Track key performance metrics to identify potential issues before they escalate.

- Stock Level Tracking: Monitor their inventory levels for your key SKUs. A sudden drop can signal production issues, allowing you to secure a backup or adjust marketing spend before a stockout occurs.

- Lead Time Adherence: Track whether they consistently meet their promised lead times. Increasing fulfillment times may indicate capacity constraints that need to be addressed before they disrupt your inventory planning.

2. Market and Pricing Compliance

How your products are priced by all retailers significantly affects your brand's perceived value.

- MAP/RRP Violation Tracking: Monitor whether your supplier’s other retail partners are adhering to your pricing policies. Widespread discounting by other sellers erodes your margins and devalues your brand.

Manually tracking prices across numerous suppliers and retail websites is impractical. For a comprehensive overview of solutions, see our guide on ecommerce price monitoring tools. This is where automated platforms become essential. An automated solution provides the visibility needed to ensure the entire reseller network adheres to your pricing policies, protecting your brand and profitability.

Got Questions About Finding Wholesale Suppliers? Let's Unpack Them.

Several key questions consistently arise for ecommerce managers and founders entering the wholesale sourcing process. The answers directly influence profit margins, logistics, and brand strategy.

Wholesale Supplier vs. Distributor: What's the Real Difference?

A wholesale supplier is typically the manufacturer—the entity that produces the goods. They sell direct, usually in very large quantities.

A distributor acts as an intermediary. They purchase in bulk from multiple manufacturers and then sell smaller, more manageable quantities to retailers.

For most new or growing businesses, starting with a distributor is the more practical choice. Their lower Minimum Order Quantities (MOQs) reduce the initial capital investment in inventory, lowering risk. As your business scales and sales velocity becomes predictable, purchasing directly from the manufacturer can significantly improve margins. The optimal choice depends on your current scale and cash flow.

How Do I Know if an Overseas Supplier is Legit?

Vetting an overseas supplier is the most critical step in mitigating risk. Due diligence is non-negotiable before any funds are transferred.

Use this vetting checklist:

- Official Business Registration: Verify their business license through official government portals in their country of operation.

- Third-Party Verification: Utilize services on platforms like Alibaba, which offer verification checks of a supplier's legal status and may include on-site inspections.

- Mandatory Samples: Never proceed without ordering and evaluating product samples. This is the only way to assess quality and test their shipping process.

- Live Video Tour: Request a video call to tour their facility. A legitimate operation will have no issue with this and it helps confirm they are not just a trading office.

- Check References: Request and contact references from other customers, preferably those in your own country. Inquire about their direct experiences with quality, communication, and reliability.

Should I Go with a Domestic or Overseas Supplier?

This decision involves a trade-off between cost, speed, and logistical complexity. The right answer depends on your product, market, and business priorities.

Domestic suppliers offer faster shipping, simplified communication, and more straightforward quality control. However, this convenience typically comes at a higher unit cost.

Overseas suppliers provide access to lower production costs, which can create significant margin advantages. This requires managing longer lead times, customs, import duties, and potential communication barriers.

Many successful brands employ a hybrid model: sourcing high-volume, core products from overseas to maximize cost efficiency, while using domestic suppliers for new product tests, fast-turnaround items, or products requiring stringent quality control.

This blended strategy provides a balance of cost savings and operational agility. Ensuring brand value and price integrity across this complex supply chain is a major challenge. This is where automated price monitoring tools like Market Edge become useful.