What was once a niche tool for analysts is now a core strategic asset for any B2B or ecommerce company. The right price monitoring software moves your pricing strategy from reactive guesswork to a data-driven advantage, with a direct impact on profit margins, market share, and brand integrity.

Why Price Monitoring Is a Commercial Necessity

In a transparent and volatile market, making pricing decisions in a vacuum is a direct path to lost revenue. While your team debates a price change, competitors have already adjusted theirs based on live market data, winning sales that should have been yours. Price monitoring has graduated from a "nice-to-have" to a business essential, on par with your CRM or ERP system.

Manual tracking is no longer a viable option. Assigning an employee to visit competitor websites is a relic of a slower era. The sheer scale and speed of modern commerce, where prices can change multiple times a day based on algorithms, promotions, and inventory levels, make it impossible to keep up. Manual processes are not just inefficient; they guarantee you will always be reacting too late.

The Market Forces Driving Automation

Several key market shifts have made automated price monitoring a non-negotiable for B2B decision-makers. Ignoring these drivers is a significant commercial risk.

Here’s what is driving the change:

- Market Volatility: Supply chain disruptions, unpredictable demand, and aggressive competitor tactics create a constant pricing battlefield. Without real-time data, you risk either underpricing and leaving money on the table or overpricing and losing the sale entirely.

- Complex Sales Channels: Brands now sell through a mix of direct-to-consumer (DTC) sites, marketplaces like Amazon, and distributor networks. Maintaining price consistency and enforcing MAP/RRP policies across this complex web is impossible without automated oversight.

- Empowered B2B Buyers: Today’s buyers have sophisticated price comparison tools at their fingertips. If your pricing is not aligned with the market, you risk being excluded from consideration early in the procurement process.

Effective price monitoring bridges the gap between your strategy and real-world market dynamics. It provides the intelligence needed to protect margins, defend your brand’s value, and make profitable decisions in real time.

From Niche Tool to Core Infrastructure

The numbers confirm this shift. The global price monitoring software market is projected to reach USD 1.92 billion in 2025 and grow to USD 5.09 billion by 2034. This is not the sign of a niche tool; it reflects the adoption of mainstream business infrastructure. You can explore the full market projections on Business Research Insights to understand the scale of this trend.

This rapid growth signals that the market views these platforms as foundational. For a deeper analysis, learn about the fundamentals of competitive price monitoring software in our guide.

Ultimately, the goal is not just to observe competitor actions. It's about converting that data into a strategic advantage—and that’s precisely where a tool like Market Edge becomes useful.

Understanding The Core Features of Top Platforms

When evaluating price monitoring software, it's easy to get lost in technical jargon. The real challenge is to identify which features deliver a measurable commercial advantage. A basic tool might show a competitor’s current price, but a powerful platform reveals how that price compares to the market, whether the product is in stock, and what your next strategic move should be.

Think of these features as the components of your pricing engine. Each serves a specific, vital function. When they work together seamlessly, they provide the control needed to navigate competitive markets. Without them, you are operating with incomplete information, risking inefficient pricing and potential breakdowns in your channel strategy.

Foundational, Non-Negotiable Features

These are the features that form the bedrock of any professional price monitoring system. They are the core functions that distinguish a professional-grade tool from a simple web scraper.

- Automated Data Collection: This is the core of the system. The software must operate 24/7, pulling pricing data from competitor sites, marketplaces, and other sales channels. This eliminates manual data entry and ensures your intelligence is always current.

- AI-Powered Product Matching: Accuracy is critical. You must be certain you are comparing your products to the correct competitor listings. Modern platforms use AI to intelligently match your SKUs to theirs, even when product names, descriptions, or part numbers vary slightly. This precision prevents costly mistakes based on mismatched data.

- Real-Time Alerts and Reporting: Data is only valuable if it is actionable. A top-tier platform allows you to set up custom alerts—delivered via email, Slack, or an in-app dashboard—for events that matter. You will know the moment a competitor makes a critical price drop, runs out of stock, or violates your pricing policy, enabling an immediate response.

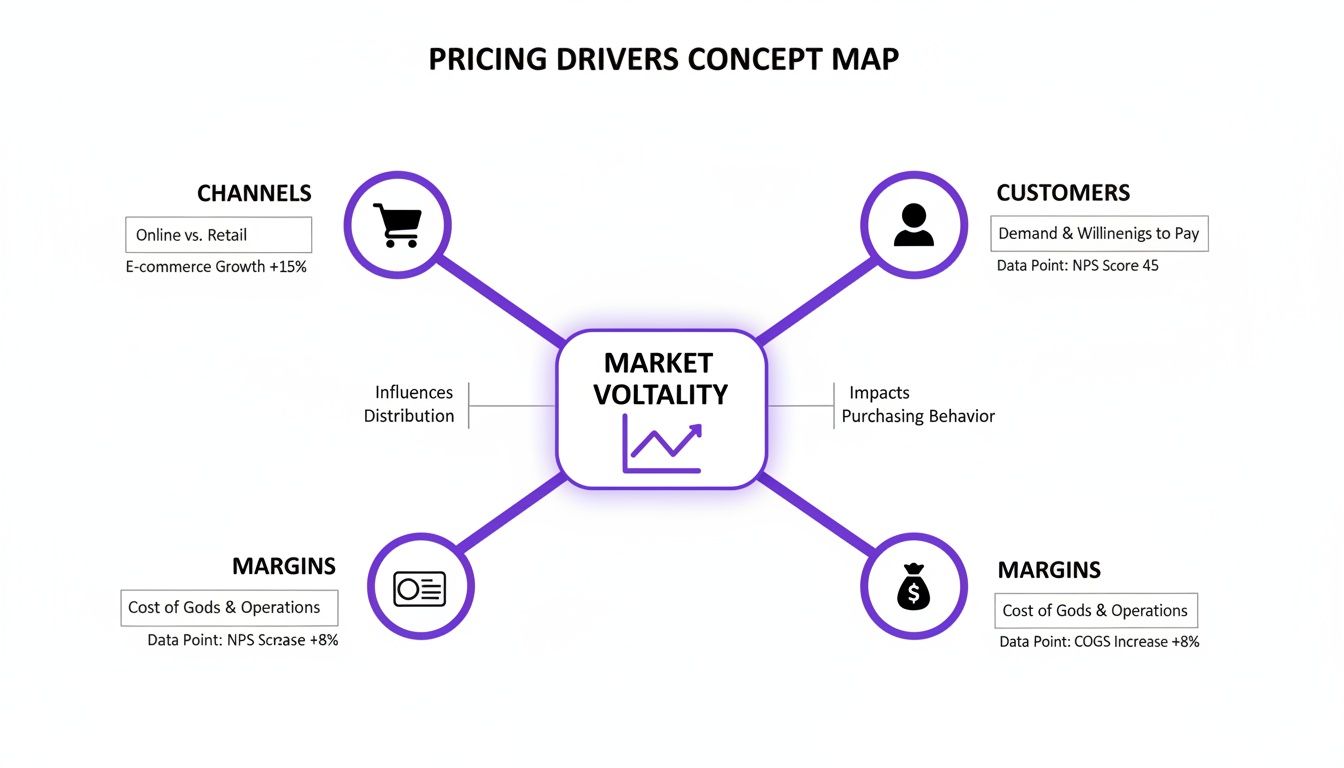

These core features work together to provide a reliable, always-on view of the market. As the image below illustrates, pricing is influenced by a mix of interacting forces like channel dynamics, customer behavior, and internal margin pressures.

The key takeaway is that pricing decisions do not happen in a vacuum. They are a response to a web of interconnected pressures that only a comprehensive monitoring tool can effectively track.

Features That Provide a Strategic Edge

Once the fundamentals are covered, you can look for specialized features that solve specific business challenges, particularly for manufacturers and B2B distributors. These capabilities elevate a simple monitoring tool into a strategic business intelligence platform.

This table breaks down essential features and explains their commercial relevance.

Essential Price Monitoring Software Feature Checklist

| Feature | What It Does | Why It Matters Commercially |

|---|---|---|

| MAP/RRP Monitoring | Automatically detects when resellers advertise your products below the agreed-upon Minimum Advertised Price (MAP) or Recommended Retail Price (RRP). | Protects your brand's premium positioning, prevents margin erosion across your sales channels, and ensures a fair playing field for all authorized partners. |

| Stock Availability Tracking | Monitors competitor inventory levels and flags out-of-stock situations for specific products. | Creates immediate sales opportunities. When a competitor cannot fulfill demand, you can step in to capture their customers and market share. |

| Historical Price & Trend Analysis | Collects and stores pricing data over time, allowing you to visualize historical trends, seasonality, and competitor pricing patterns. | Informs smarter long-term strategy. You can identify pricing cycles, anticipate competitor promotions, and set prices based on historical context, not just today's snapshot. |

| Dynamic Pricing Rules Engine | Lets you create automated "if-this-then-that" rules to adjust your own prices in response to specific market triggers (e.g., competitor price drops, stock changes). | Enables you to stay competitive without constant manual intervention. It helps capture margin when possible and defend market share when necessary, automatically. |

| API & System Integration | Provides an API (Application Programming Interface) to connect the pricing data directly into your other business systems, like your ERP or e-commerce platform. | Creates a single source of truth for pricing intelligence across your organization, enabling more cohesive and data-driven decision-making from sales to marketing. |

These advanced functions are what separate market leaders from the rest, providing the tools to not just react to the market, but to shape it.

MAP/RRP Enforcement Use Case

For any brand owner, protecting your product's perceived value is critical. MAP (Minimum Advertised Price) monitoring is your front-line defense, automatically scanning your reseller network for unauthorized discounts.

Example: A brand manager receives an instant alert when a third-party seller on Amazon drops a flagship product below its MAP. The alert includes a time-stamped screenshot for proof. Instead of manually policing hundreds of websites, the software flags the violation the moment it happens, allowing for swift enforcement action that protects brand integrity and maintains trust with authorized partners.

Stock Availability Tracking Use Case

Knowing if a competitor can fulfill an order is a powerful piece of intelligence. Tracking stock availability reveals when a competitor is failing to meet demand, opening a direct opportunity for your sales team.

Example: When a top competitor’s best-selling item goes out of stock, your sales team is automatically notified. They can immediately begin targeting that competitor's customers with outreach, offering your in-stock alternative to capture immediate sales.

The best price monitoring platforms are now full-blown analytics engines, offering everything from competitor price tracking to interactive dashboards. It’s no surprise that the e-commerce sector is projected to be the dominant user of these tools, as online competition moves too fast to manage without them. You can read the full research on price monitoring software trends to see how central this technology has become.

This is where an automated, enterprise-grade tool like Market Edge provides significant value.

How to Evaluate and Select the Right Software

Choosing price monitoring software is a strategic decision that directly shapes revenue and market position. The right platform provides a significant competitive edge, while the wrong one becomes a resource drain, feeding you unreliable data. To make the right choice, you must focus on what drives commercial results.

The evaluation process boils down to three key areas: data quality, platform scalability, and ease of use. A tool can have a polished dashboard, but if the data is inaccurate or delayed, it is actively misleading. Likewise, a system that cannot handle your product catalog growth or requires a data scientist to operate creates more problems than it solves.

Data Accuracy and Refresh Rate

The foundation of any price monitoring system is its data. If you cannot trust the numbers, every decision based on them is a gamble. Therefore, the first questions for any vendor must be about data accuracy and update frequency.

You need to know how the software gathers its information. Is it pulling prices in near real-time, or is there a 24-hour lag? In a market that moves at the speed of e-commerce, yesterday's price is obsolete. Clarify their data refresh cycles and ask for uptime guarantees.

A critical component of accuracy is product matching. Older systems rely on manual mapping or rigid rules that fail when a competitor alters a product title. This is where AI-driven matching becomes a non-negotiable feature.

Modern AI can intelligently connect your SKUs to competitor listings, even when names, descriptions, or part numbers do not perfectly align. This ensures you are always comparing apples to apples, avoiding costly mistakes. This level of precision is where a platform like Market Edge demonstrates its worth, ensuring your foundational data is clean from the start.

Scalability for Your Product Catalog

Your business is built for growth, and your software must be able to keep pace. A solution that handles 500 SKUs today might fail when you reach 50,000. When evaluating platforms, consider where your business will be in two years, not just where it is now.

Ask direct questions about scalability:

- SKU Capacity: Is there a limit on the number of products you can track? How does the pricing change as your catalog grows?

- Competitor and Marketplace Limits: Are you limited to a small number of competitors or marketplaces? For businesses selling across multiple channels, this can be a deal-breaker.

- Performance Under Load: Will the platform slow down as you add more products and competitors? Request case studies or a reference from a company with a catalog of a similar scale.

A truly scalable tool allows you to expand your monitoring without performance degradation or prohibitive fees, ensuring the software remains an asset, not a bottleneck.

A Practical Checklist for Your Proof of Concept

A free trial or Proof of Concept (POC) is your opportunity to test a platform against your real-world requirements. Go into the trial with a clear plan and a checklist of questions to answer. This hands-on evaluation will reveal more than any sales demonstration.

Use this checklist to guide your POC:

- Onboarding Efficiency: How quickly can we load our core products and begin tracking our top 10 competitors? This should be a straightforward process, not a multi-week project.

- Product Matching Accuracy: For our most complex products, what is the actual match rate? When the AI flags a potential mismatch, how easy is it to correct?

- Alert Customization: Can we configure alerts for key business events, such as a reseller breaking MAP or a competitor going out of stock on a key product? This is critical for brand protection, a topic we cover in our guide to the best MAP monitoring software.

- Reporting and Analytics: Does the dashboard provide clear, actionable insights, or is it just a wall of data? How easily can we export a clean report for sales, marketing, and leadership teams?

- Support and Training: During the trial, what level of support is provided? Is their team responsive and knowledgeable about our business model (e.g., B2B distribution vs. D2C brand)?

By methodically working through these points, you can make a decision based on how the software truly performs for your team. This practical approach is where automated price monitoring tools like Market Edge demonstrate their real value.

Measuring the ROI of Your Price Monitoring Investment

To secure a budget for any new tool, you need a solid business case. Price monitoring software is an investment designed to directly increase revenue and profitability. The goal is to draw a straight line from the platform's features to tangible financial outcomes. This is not about abstract benefits; it's about building a clear, numbers-driven argument.

The return from a price monitoring platform shows up in improved margins, a protected brand, and more efficient sales cycles. The key is to view the software not as an expense, but as a revenue-generating asset.

Key Performance Indicators to Track

To build a compelling business case, focus on specific Key Performance Indicators (KPIs) that the software can directly influence. These metrics bridge the gap between the data on your screen and your company’s bottom line.

Track concrete outcomes like these:

- Direct Margin Improvement: Measure how data-driven price adjustments increase the average gross margin on key product lines. A 1-2% increase across a large catalog can deliver a significant return.

- Reduced MAP/RRP Violations: For brands, this is a critical metric. Measure the frequency and severity of Minimum Advertised Price (MAP) violations before and after implementation. A sharp decrease directly protects your brand's value and improves channel relationships.

- Increased Competitive Win Rate: For B2B sales teams, track how often your quotes win against key competitors. When your team is equipped with real-time market pricing, they can quote with greater confidence and precision.

- Sales Lift on Underpriced SKUs: Identify products you have been selling for less than the market average. After adjusting prices based on data, measure the resulting increase in revenue and margin.

A common mistake is to focus only on time saved through automation. The real value is in the strategic upside—winning deals you were previously losing, capturing margin you were leaving on the table, and defending your brand's long-term value.

By focusing on these KPIs, you can create a direct line from the software's subscription cost to measurable financial gains. You can learn more about how these metrics fit into a broader strategy by understanding the role of pricing analytic software.

Real-World ROI Examples

Let's look at how this plays out for a real business. The impact of the right price monitoring software is often demonstrated within the first few quarters.

Use Case 1: B2B Distributor Increases Win Rate

An industrial parts distributor was consistently losing bids to a handful of competitors. They implemented a price monitoring solution to track the pricing of their top 500 products across their three main rivals.

- Action: Sales reps began using the data to inform their quotes. They could strategically match or slightly undercut competitors on key deals while holding firm on their price where they had a competitive advantage.

- Result: Within six months, their competitive quote win rate increased by 15%. The additional margin from just a few of these new contracts more than covered the annual cost of the platform.

Use Case 2: Manufacturer Enforces MAP and Restores Channel Health

A consumer electronics brand was struggling with rampant discounting from unauthorized sellers on Amazon, which was damaging relationships with their authorized dealers.

- Action: They implemented an automated MAP monitoring tool that flagged and documented every violation in near real-time. This provided the hard evidence needed to systematically enforce their pricing policy.

- Result: The brand reduced unauthorized discounting by 80% within the first three months. This stabilized market pricing, rebuilt trust with legitimate retail partners, and protected the brand's premium image.

These examples show how actionable data generates a clear and defensible return. This is where automated price monitoring tools like Market Edge come into play.

Rollout Plan: Implementing Your New Software for Quick Wins

Implementing new software can seem daunting. The key to a successful rollout is not a single, large-scale launch, but securing quick, tangible wins that build momentum and prove the tool's value early on. A phased, strategic implementation gets your team productive quickly, turning data into decisions from day one.

The goal is to avoid "analysis paralysis," a common trap where teams are overwhelmed by data. A structured approach transforms a potential IT project into a series of manageable, high-impact steps.

Phase 1: Define Clear Objectives and a Pilot Group

Before you track a single price, define what success looks like. Your initial goals must be specific, measurable, and tied to a commercial outcome. Attempting to monitor your entire catalog at once is a recipe for failure. Instead, focus your efforts where they will have the greatest impact quickly.

Select a small, strategic pilot group of SKUs and competitors. This focused scope allows you to test workflows and demonstrate the software's value without being overwhelmed.

A strong pilot group typically includes:

- High-Volume Sellers: Your core products where even a small margin improvement yields significant revenue.

- Known Competitive Battlegrounds: SKUs where you are in constant price competition with key rivals.

- MAP Violation Hotspots: For brands, these are the products frequently discounted by unauthorized sellers.

Starting small creates a controlled environment to learn the software and refine your strategy, building confidence within your team.

Phase 2: Integrate Data and Configure Smart Alerts

With your pilot group defined, it's time to import your product data and set up intelligent alerts. This is where automation begins to shift your team from reactive problem-solving to proactive strategy.

Importing data should be straightforward. Most modern platforms offer simple CSV uploads or direct API connections to your e-commerce platform or ERP. The key is ensuring your product identifiers (like SKUs or EANs) are clean and consistent.

Next, configure alerts that directly support the goals set in Phase 1. For example:

- Price Change Alerts: Set a rule to notify the pricing manager any time a key competitor drops their price on a pilot SKU by more than 5%.

- MAP Violation Alerts: For brand protection, create an immediate notification (with a screenshot) that goes to your compliance team whenever a reseller lists a product below its MAP.

- Stock-Out Alerts: Configure an alert to inform your sales team the moment a primary competitor runs out of a high-demand item, creating a direct sales opportunity.

This is where the platform begins working for you. You are building an automated market intelligence system that only surfaces events requiring a strategic response, freeing your team from manual checks.

Phase 3: Train the Team and Turn Data into Action

Software is only as effective as the people using it. The final phase is training stakeholders to integrate the data into their daily work. This is not about a single training session, but about connecting the platform's insights directly to their roles and responsibilities.

For a sales leader, this could mean starting each day by reviewing competitor stock-outs to identify immediate sales targets. For a pricing manager, it might involve a weekly analysis of historical price trends to inform upcoming promotions. The goal is to make the software an indispensable part of their routine.

This phased, win-focused approach is what platforms like Market Edge are designed for. They facilitate rapid onboarding to deliver value quickly, demonstrating a clear ROI within the first quarter. This is where automated price monitoring tools prove their worth.

Vendor-Fit Checklist for B2B Enterprises

For large B2B distributors and manufacturers, the requirements are more demanding. You need a solution that handles complexity, scale, and industry-specific nuances. Use this checklist to evaluate if a potential vendor is enterprise-ready.

| Evaluation Criteria | What to Look For | Why It's Critical for Enterprise |

|---|---|---|

| Data Scalability & Accuracy | Can the system track millions of SKUs across thousands of competitor sites without sacrificing accuracy or speed? Ask about their data validation process. | Enterprises deal with massive, complex catalogs. Inaccurate or slow data on that scale leads to costly errors and missed opportunities. |

| B2B-Specific Features | Does it support tracking of customer-specific pricing, tiered discounts, RFQs, and private portals? Can it handle complex product configurations? | Standard B2C tools can't capture the nuance of B2B sales cycles, where pricing is often negotiated and not publicly listed. |

| Integration Capabilities | Look for a robust API and pre-built connectors for major ERPs (like SAP, Oracle), CRM (like Salesforce), and PIM systems. | The tool must fit seamlessly into your existing tech stack to avoid data silos and enable automated workflows across departments. |

| Customization & Reporting | Can you build custom dashboards, reports, and alerts tailored to different teams (sales, marketing, pricing)? How flexible is the reporting engine? | One-size-fits-all reporting doesn't work. Each department needs to see the data through the lens of its own KPIs and objectives. |

| Security & Compliance | Does the vendor have enterprise-grade security certifications (e.g., SOC 2, ISO 27001)? What are their data privacy and handling policies? | Protecting sensitive pricing and customer data is non-negotiable. A breach could have severe financial and reputational consequences. |

| Support & Onboarding | Do they provide a dedicated account manager? What does their onboarding and training process look like for large, distributed teams? | A complex implementation requires a true partnership, not just a help desk. You need expert guidance to ensure a smooth rollout and adoption. |

This checklist helps you cut through marketing claims. A platform like Market Edge is built with these enterprise-level requirements at its core, ensuring it can handle the scale and complexity your business demands.

Common Pitfalls to Avoid with Price Monitoring Tools

Knowing what not to do is as important as knowing what to do. Many companies invest in excellent price monitoring software only to see the initiative fail due to poor implementation. The most common mistakes stem from a misunderstanding of what drives value, leading to wasted budget and missed opportunities.

Avoiding these traps is what separates a successful implementation from a failed one. The key is to treat the tool not just as a data feed, but as a strategic asset integrated into your commercial strategy.

Pitfall 1: Choosing a Tool Based on Price Alone

This is the most common mistake. Teams tasked with finding a solution often gravitate toward the cheapest option. While budget is a constraint, a low-cost tool that provides inaccurate or stale data is worse than no tool at all. Bad data leads to poor decisions, which can damage margins and your credibility with channel partners.

Data quality must be the primary consideration. A greater investment in a platform with reliable, real-time data and sophisticated AI-powered product matching will pay for itself many times over through smarter decisions and the avoidance of costly errors.

Pitfall 2: Tracking Too Many Irrelevant Competitors

It is tempting to monitor every competitor. However, this wide-net approach often backfires, leading to "analysis paralysis." Your team becomes buried under noisy, irrelevant data from minor players who have no real impact on your market share.

Instead of trying to monitor everyone, focus your resources on the 5-10 key rivals who are actually influencing market pricing. This focused approach provides clean, actionable intelligence that your team can use to make fast, impactful decisions without getting lost in the noise.

Pitfall 3: Failing to Integrate Data into Daily Workflows

This is the most critical mistake. A company buys a tool, and the pricing data sits in a report that is reviewed once a week. If the data lives in a silo, it is useless. To achieve a real ROI, the insights must be woven into the daily routines of your sales, marketing, and pricing teams.

Here is how to put the data to work:

- For Sales Teams: Feed stock-out alerts directly into their morning huddle. When a key competitor runs out of a popular product, it is a sales opportunity that your team must act on immediately.

- For Pricing Managers: Use historical trend data to build your promotional calendar. Base promotions on how competitors have priced similar products during past seasonal events.

- For Brand Managers: Set up automated MAP violation alerts that feed directly into their enforcement workflow, complete with screenshots for proof.

When you connect the data directly to these commercial actions, the software becomes an active part of your revenue engine. This is where automated tools like Market Edge excel, by making this integration seamless.

Common Questions About Price Monitoring

When investigating price monitoring software for the first time, several questions typically arise. Here are the direct answers for B2B leaders evaluating this technology.

Isn't This Just Web Scraping?

No. While web scraping is the underlying technology for data collection, it is only one component of a much larger system. Think of scraping as the engine; a price monitoring platform is the entire vehicle.

A true price monitoring platform takes raw data and transforms it into actionable intelligence. It cleans the data, uses AI to match your products to competitors' (even with different names or SKUs), analyzes historical trends, and sends alerts on critical events. Scraping provides a messy spreadsheet; a monitoring platform delivers strategic insights to your dashboard.

Can It Track Prices on Marketplaces Like Amazon?

Yes. This is one of the most critical functions of a modern platform. The best price monitoring tools are designed to navigate the complexity of marketplaces where dozens of sellers may compete for the same product listing.

They can identify who owns the "Buy Box," track pricing from every seller on a page, and flag unauthorized third-party sellers who may be violating your MAP policy. For any company selling through multiple channels, this is a non-negotiable capability. Platforms like Market Edge are built specifically to provide brands with a complete view of their products across all major marketplaces.

How Often Is the Data Updated?

Data freshness is crucial. Some basic tools may only refresh prices once every 24 hours, but in a fast-moving market, that data is already obsolete. You will miss important pricing moves made by your competitors.

The best price monitoring software provides updates in near real-time, with multiple refreshes throughout the day or even hourly for your most important products. When evaluating vendors, ask for their specific data refresh rates and uptime guarantees. Stale data leads to poor decisions and undermines the entire investment.

This is where automated price monitoring tools like Market Edge become useful.