A competitive pricing strategy is the practice of setting prices based on what rivals are charging. Instead of focusing solely on internal costs or perceived value, this approach anchors your prices to the external market. For B2B decision-makers, it's a critical lever for influencing sales, market share, and profitability.

Understanding Competitive Pricing Strategy

For a founder, ecommerce manager, or sales leader, mastering competitive pricing is a core commercial responsibility. Your price is a direct signal to the market about your position. Deciding to price above, below, or in line with competitors has immediate commercial consequences.

This isn't just theory. Companies that use data and analytics to inform competitive pricing see tangible improvements in revenue and margins. Conversely, with 64% of companies reporting increased price pressure, ignoring competitor actions is a direct path to margin erosion. To explore the mechanics further, you can learn more about mastering competitive pricing analysis.

Why It Matters Commercially

A well-executed competitive pricing strategy provides a clear framework for navigating crowded markets and protecting profitability.

Here's the practical impact on your business:

- Increase Sales Volume: Aligning with market expectations attracts price-sensitive buyers, driving higher unit sales.

- Defend Market Share: Monitoring competitor pricing allows you to react preemptively, preventing customer churn due to better offers elsewhere.

- Gain Actionable Market Insights: The process of competitor tracking provides a continuous stream of data on market trends, competitor behavior, and your relative position.

- Strengthen Brand Positioning: Your price point relative to others quickly communicates your value proposition—whether you are the premium, value, or budget option.

Ultimately, this strategy shifts decision-making from intuition to data. By understanding the different approaches and their trade-offs, you can build a more resilient and profitable business.

Core Competitive Pricing Positions at a Glance

Your competitive stance can be simplified into three primary positions: pricing above, below, or matching your competitors. Each serves a distinct business goal and carries its own risks and rewards.

The table below breaks down these core positions.

| Pricing Position | Description | Best For | Potential Risk |

|---|---|---|---|

| Price Above Competitors | Setting prices higher than the market average to signal superior quality, service, or features. | Businesses with a strong brand, unique value proposition, or demonstrably better product. | Alienating price-sensitive customers or failing to justify the premium, leading to low sales volume. |

| Price Below Competitors | Intentionally undercutting competitor prices to attract a large volume of customers quickly. | New market entrants, distributors clearing excess inventory, or businesses aiming for high market share. | Can trigger a price war, erode profit margins, and create a perception of lower quality. |

| Price Match Competitors | Aligning prices directly with key competitors to neutralize price as a buying decision factor. | Companies in highly commoditized markets where differentiation is difficult and customer loyalty is low. | Can lead to a "race to the bottom" and makes it difficult to stand out on factors other than price. |

Choosing the right position is not a one-time decision. It requires ongoing analysis of the market, your costs, and customer perception of value.

Choosing Your Competitive Pricing Approach

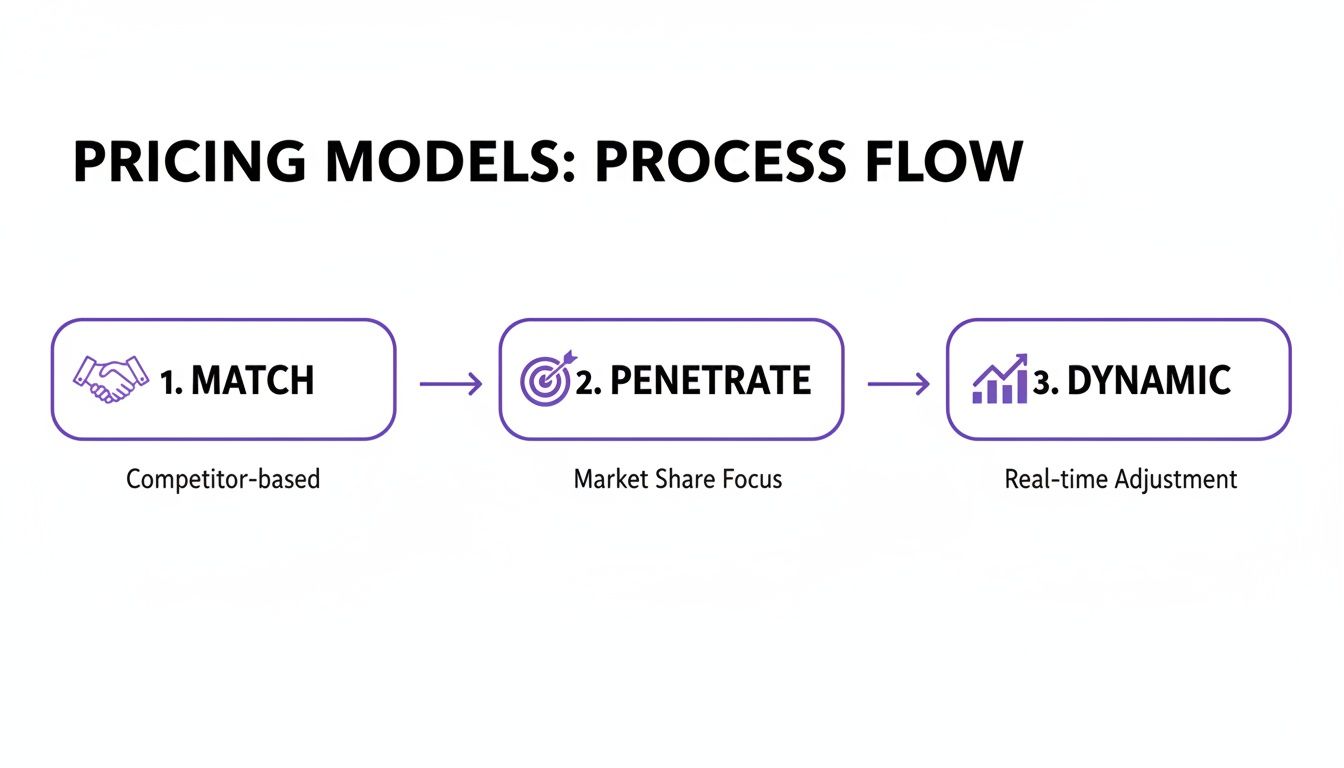

Once you understand the basic positions, the next step is selecting the right approach for your specific commercial goals. The strategy for a new market entrant seeking share will differ entirely from an established brand protecting its premium status.

Are you fighting for market share, building customer trust, or adapting to a fast-moving market? Each goal requires a different pricing playbook.

Price Matching for Stability and Trust

Price matching involves pegging your prices directly to a key competitor's. The goal is to neutralize price as a decision-making factor, forcing customers to choose based on other differentiators like service, quality, or delivery speed.

This is highly effective in commoditized markets where products are largely interchangeable. It prevents customers from switching for minor price differences, building a reputation for fairness and reliability.

- B2B Use Case: An industrial parts distributor uses a price monitoring tool to automatically match the prices of its top three competitors on its 20% most frequently purchased SKUs. This neutralizes price, allowing the distributor to win business on its core strengths: superior logistics and expert technical support.

Penetration Pricing to Capture Market Share

Penetration pricing is an aggressive strategy where you launch with a price significantly lower than the competition. The objective is to rapidly acquire a large customer base and establish market presence. This is a volume play, not a profit play, in the short term.

This approach is only viable if you can sustain the initial margin hit. Success requires either the scale to profit from high volume or a clear plan to raise prices once a loyal customer base is established.

Key Takeaway: Penetration pricing is a short-term tactic for a long-term strategic gain. Without a clear path to profitability, it can initiate a price war that permanently devalues your brand.

Dynamic Pricing for Real-Time Agility

In fast-paced ecommerce marketplaces, prices can change multiple times a day. Dynamic pricing uses automated software to adjust prices in real time based on competitor pricing, demand, and inventory levels.

The commercial logic is compelling. You can automatically increase prices to capture margin when a competitor goes out of stock or instantly lower a price to remain competitive during a sale. However, its effectiveness depends entirely on clean, real-time data. This is where automated platforms such as Market Edge Monitoring become essential, providing the intelligence needed for these split-second decisions.

When to Look Beyond Competitors

Knowing when to ignore competitor pricing is just as critical. Following the market is not always the right move.

For instance, value-based pricing sets your price according to the tangible value your product delivers, not what another company charges. If your solution solves a significant customer problem that competitors don't, tying your price to an inferior product leaves money on the table.

Manufacturers also operate with different constraints. Their pricing must support their distribution channels. A Minimum Advertised Price (MAP) policy, for example, is designed to protect brand value and ensure channel partner profitability. You can explore the difference between MAP and MSRP policies to understand these dynamics. Such strategic channel management goals almost always override a reactive price change.

How to Build Your Pricing Strategy From the Ground Up

Effective implementation requires a clear, repeatable process. A robust competitive pricing strategy is a deliberate framework built on accurate data, not guesswork. The process begins with collecting the right intelligence and ends with deploying automated, rule-based execution. The first step is to move beyond manual spreadsheets.

Step 1: Identify Your True Competitors

Not every company selling a similar product is a direct competitor. A common mistake is tracking too broad a field of rivals, which floods your analysis with irrelevant noise. Focus on the businesses fighting for the same customers.

Segment competitors into tiers to prioritize your efforts:

- Primary Competitors: Direct rivals with similar products targeting the exact same customer profile.

- Secondary Competitors: Companies selling high-end or low-end versions of your product, or those targeting an adjacent customer segment.

- Tertiary Competitors: New entrants or businesses with related products that could pose a future threat.

This tiered approach focuses your resources on the competitors that have the most significant commercial impact.

Step 2: Gather Clean and Accurate Pricing Data

Your strategy is only as good as the data it's built on. For businesses managing hundreds or thousands of SKUs, manual price checking is slow, error-prone, and provides only a single snapshot in time.

Automated data collection is a commercial necessity. A vendor-neutral workflow involves implementing systems to monitor competitor product pages and marketplaces. These systems match your SKUs to theirs and extract key data points—price, stock levels, shipping costs—in near real-time. Our guide on competitor price monitoring software details how this process works.

Step 3: Analyze Your Market Position and Set Rules

With a steady stream of clean data, you can accurately map your market position. Identify where you are priced higher, lower, or the same as primary competitors. This analysis will reveal strategic opportunities. For example, you might discover a key competitor is consistently out of stock on a popular product, creating an opportunity for you to capture their sales, often without lowering your price.

The goal is to move from reactive price matching to proactive, rule-based pricing. Instead of copying every move, you create intelligent rules that align with your business objectives.

For instance, a rule could automatically price a specific product line 5% below the market leader, but with a price floor that protects your target gross margin. Or you could price-match a primary competitor on a handful of key items while maintaining a premium on accessories. Platforms such as Market Edge can automate this process, translating your strategic goals into enforceable rules for confident, scalable price adjustments.

Why This Strategy Is a Game-Changer for B2B Brands

For manufacturers and distributors, competitive pricing is not just a sales tactic—it is fundamental to defending margins and protecting brand integrity. In the B2B ecosystem, pricing decisions impact channel partner relationships, perceived market value, and long-term profitability in ways that direct-to-consumer models do not.

Unlike D2C brands that can adjust prices freely, manufacturers and distributors must balance being competitive enough to win business while supporting their reseller networks and preventing discounting from eroding brand equity.

The Manufacturer’s Dilemma: Brand Protection and MAP Enforcement

A primary challenge for manufacturers is controlling product pricing in the retail channel. When a third-party seller violates your Minimum Advertised Price (MAP) policy, it devalues the entire brand.

This triggers immediate channel conflict, as authorized dealers who adhere to the policy are undercut by unauthorized sellers. This damages critical partner relationships. Therefore, continuous price monitoring is not optional; it is the foundation of any effective MAP enforcement program.

Mini Case Study: A premium electronics brand discovered its flagship headphones were being sold on Amazon for 15% below MAP by unauthorized resellers. This squeezed loyal retail partners and diluted the product's perceived value. By deploying an automated tracking system, they identified violating sellers within days. The system logged timestamped proof and issued automated initial warnings. Within three months, public MAP violations dropped significantly, stabilizing channel pricing and rebuilding trust with authorized dealers.

The Distributor’s Edge: Margin Defense and Sourcing Advantages

Distributors operate on thin margins where small pricing errors have a significant bottom-line impact. For them, a competitive pricing strategy is about survival and opportunity. They must constantly benchmark prices to ensure they are not overpaying suppliers or being priced out of the market.

Recent market volatility has intensified this pressure. According to Simon-Kucher’s 2025 Global Pricing Study, 64% of companies face increased price pressure and struggle to pass on rising costs. This makes real-time market intelligence essential for protecting profits. You can learn more about how market pressures are shaping pricing decisions in the full report.

Monitoring competitor stock levels alongside prices provides a key strategic advantage. If a primary competitor is low on inventory for a key product, that is a signal to hold your price firm—or even raise it slightly—to capture unmet demand.

This intelligence also drives smarter purchasing decisions, helping you avoid overstocking items that competitors are already liquidating at a loss. This is where automated platforms like Market Edge provide the clarity needed to turn market data into margin-saving actions.

Common Mistakes That Erode Profitability

While a competitive pricing strategy can provide a significant advantage, common pitfalls can turn it into a margin-destroying liability. Understanding these traps is the first step toward building a strategy that grows profit, not erodes it.

The most common mistake is being drawn into a race to the bottom. This occurs when businesses compete solely on price, triggering a downward spiral of undercutting. The result is compressed margins for the entire market and the commoditization of your brand.

Another critical error is making decisions based on stale or incomplete data. In today's market, last week's price data is obsolete. Relying on outdated information means you might cut prices unnecessarily or miss opportunities to increase them when a competitor stocks out.

Ignoring Non-Price Competitive Factors

Price is only one element of a competitor's offer. An effective strategy must analyze the complete picture. Ignoring factors beyond the price tag leads to flawed analysis and poor decisions.

Smart pricing intelligence must account for:

- Shipping Costs and Times: A lower product price is irrelevant if negated by high shipping fees or slow delivery. The total landed cost is what customers compare.

- Stock Availability: A competitor's low price is meaningless if the product is out of stock. Monitoring inventory levels reveals their true ability to supply the market and can signal opportunities to capture their customers.

- Seller Reputation and Reviews: Customers will often pay more to buy from a trusted seller. Treating a new seller with no reviews as the same threat as an established industry leader is a strategic error.

A holistic view is non-negotiable. Tracking only the sticker price means you miss the context that determines whether a competitor's price is a genuine threat or simply noise.

Treating All Competitors as Equal Threats

A surprisingly common oversight is failing to segment competitors. A local boutique and a national retailer pose different threats and require different strategic responses.

Lumping all competitors together leads to overreacting to price changes from minor players who don't share your customer base, while potentially missing a critical move by a primary rival. This creates erratic pricing that confuses customers and weakens your market position.

Effective execution requires prioritizing data from competitors who directly impact your target customers. This is where automated monitoring tools, like Market Edge, provide essential clarity, helping you filter out noise and focus on the intelligence that affects your bottom line.

Putting Your Competitive Pricing Plan Into Action

A successful competitive pricing strategy is about being smarter, not just cheaper. It is built on a foundation of clean data, clear objectives, and precise execution. For any B2B brand today, manually tracking thousands of products across a growing list of competitors is no longer feasible or reliable.

Automated price monitoring tools have become indispensable. They deliver the near real-time intelligence required to make informed decisions that protect both market share and margins. The objective is to transition from reactive price changes to proactive, data-driven pricing that creates a sustainable advantage.

Actionable Takeaway Checklist

- Define Competitor Tiers: Identify and segment your primary, secondary, and tertiary competitors. Focus 80% of your analysis on the primary group.

- Establish Data Workflow: Implement an automated system for collecting price, stock, and shipping data. Eliminate manual data entry.

- Set Clear Pricing Rules: Define your strategic position (above, below, or match) for key product categories and create automated rules with hard margin floors.

- Monitor Non-Price Factors: Integrate stock availability and seller reputation into your analysis to gain a complete market view.

- Establish a Review Cadence: Schedule regular (e.g., weekly) reviews of pricing performance to adjust rules and strategy as needed, avoiding knee-jerk reactions.

When you have a firm grasp of competitor pricing and stock, it also provides significant leverage when you learn how to negotiate with suppliers.

This is where automated price monitoring tools like Market Edge become useful, delivering the intelligence required to execute your strategy with confidence.

Got Questions? We’ve Got Answers on Competitive Pricing

Implementing a competitive pricing strategy often raises practical questions. Here are answers to common queries from B2B leaders.

How Often Should I Change My Prices Based on Competitor Data?

The frequency depends on your market's velocity. In fast-moving ecommerce, daily or even hourly price adjustments may be necessary. For most B2B distributors and manufacturers, however, such frequent changes can create customer confusion and channel conflict.

A more practical approach is to monitor data continuously but only execute price changes when strategically necessary. Establish a weekly or bi-weekly review cycle to analyze trends. This prevents overreacting to minor fluctuations while ensuring you don’t miss major market shifts.

Can We Use This Strategy If We're a Premium Brand?

Absolutely. For premium brands, competitive intelligence is used for strategic positioning, not price matching. The goal is to ensure your price premium is justified and clearly communicated to the market.

For example, if the average market price is $100 and your product is priced at $150, competitor data helps you anchor your value proposition. You can use it to highlight the specific features, superior service, or stronger warranty that justifies the 50% premium. It reinforces your value rather than diluting it.

What's the Real Difference Between Price Monitoring and Dynamic Pricing?

This is a key distinction between intelligence and action. Think of it as the input versus the output.

- Price Monitoring is the input. It is the intelligence-gathering process of tracking competitor prices, stock levels, and other market signals.

- Dynamic Pricing is the output. It is the action of using automated rules to adjust your own prices in response to the intelligence gathered through monitoring.

Effective dynamic pricing is impossible without a continuous stream of accurate data from robust price monitoring. This is where automated platforms like Market Edge bridge the gap, providing the engine for smart, automated pricing decisions.