Retail price monitoring is the systematic process of tracking competitor prices, promotions, and stock levels across online channels. It is not just about simple price checks; it is the central nervous system for a modern commercial strategy, feeding critical intelligence into pricing, sales, and marketing decisions.

For any founder, ecommerce manager, or brand leader, making pricing decisions in a silo is a significant commercial risk. While your team debates a 5% price drop internally, agile competitors may have already adjusted their prices twice based on live market data, capturing customers that should have been yours. Price monitoring transforms pricing from a reactive guessing game into a data-driven discipline.

The goal isn't to mindlessly copy every competitor's price cut. It's about arming your business with the market intelligence required to protect brand value, defend profit margins, and identify commercial opportunities before anyone else.

Why Retail Price Monitoring Is a Strategic Necessity

In a competitive ecommerce landscape, pricing is a key lever for growth and profitability. Without a clear view of the market, businesses risk overpricing products and losing sales, or underpricing them and sacrificing margins. Effective retail price monitoring provides the real-time data needed to navigate market shifts, avoid margin-eroding price wars, and chart a more profitable course.

Protecting Brand Equity and Channel Partners

For manufacturers and brand owners, maintaining consistent pricing is fundamental to brand value. When unauthorized sellers violate Minimum Advertised Price (MAP) or Recommended Retail Price (RRP) policies, it devalues the brand and creates channel conflict with authorized retail partners who adhere to the rules.

Automated monitoring is the only scalable solution for effective MAP enforcement. It provides the necessary tools by:

- Detecting Violations Instantly: The system flags any seller listing products below the agreed-upon price floor, often within minutes of the change.

- Providing Verifiable Proof: It captures time-stamped screenshots and data logs, creating an undeniable record of each violation for enforcement.

- Accelerating Remediation: Automated alerts can be sent directly to sales or compliance teams, enabling swift action to protect brand integrity and partner relationships.

Real-World Example: A premium electronics brand uses monitoring to track its MAP policy across 300 online retailers. The system detects a new marketplace seller offering a 20% discount. An alert with screenshot evidence is automatically sent to the brand's enforcement team, which contacts the marketplace and has the listing removed within hours, preventing further price erosion.

Responding to Economic Shifts and Market Volatility

Rapid inflation or supply chain disruptions can impact costs overnight. Businesses that react slowly risk severe margin compression. According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) can shift significantly in short periods, directly impacting cost of goods. For example, a 3% rise in input costs without a corresponding price adjustment can eliminate the profit margin on high-volume products.

Real-time price monitoring allows businesses to see how competitors are adjusting to these macroeconomic trends. This intelligence helps you make informed decisions about whether to absorb costs, pass them on to consumers, or find a strategic middle ground without sacrificing market share. This is where a solution like Market Edge provides value, delivering the timely data needed to adapt pricing strategies in response to market volatility.

Informing Strategic Sourcing and Inventory Decisions

Effective price monitoring extends beyond pricing to include competitor stock levels. This availability data is a valuable asset for procurement and category management teams.

- Sourcing Advantage: An importer can use competitor availability data to identify market gaps and negotiate better terms with suppliers for in-demand products.

- Sales Opportunity: A distributor who sees a major competitor go out of stock on a key product can strategically adjust pricing or promotions to capture the resulting increase in demand.

This transforms raw market data into a tangible competitive advantage. For a deeper analysis of this concept, see our guide on the role of big data in retail.

Manual Spreadsheets vs. Automated Platforms

Historically, businesses attempted to track prices manually using spreadsheets. This approach is no longer viable in the fast-paced digital marketplace.

| Attribute | Manual Monitoring (Spreadsheets) | Automated Monitoring (Platform) |

|---|---|---|

| Speed | Weekly or monthly updates; too slow for dynamic ecommerce. | Near real-time data, with updates as frequently as every few minutes. |

| Accuracy | High risk of human error from typos and data entry mistakes. | 99%+ data accuracy through automated extraction and validation. |

| Scale | Practical for only a few products and a handful of competitors. | Easily tracks thousands of SKUs across hundreds of global competitors. |

| Data Depth | Typically limited to price only. | Tracks price, stock, promotions, shipping costs, seller ratings, and more. |

| Strategic Value | Purely reactive, leaving you constantly playing catch-up. | Proactive, providing analytics and alerts to inform strategic decisions. |

The conclusion is clear: relying on manual methods today means operating with outdated, incomplete information. Automated platforms provide the speed, accuracy, and depth required to compete effectively.

How Modern Price Monitoring Technology Works

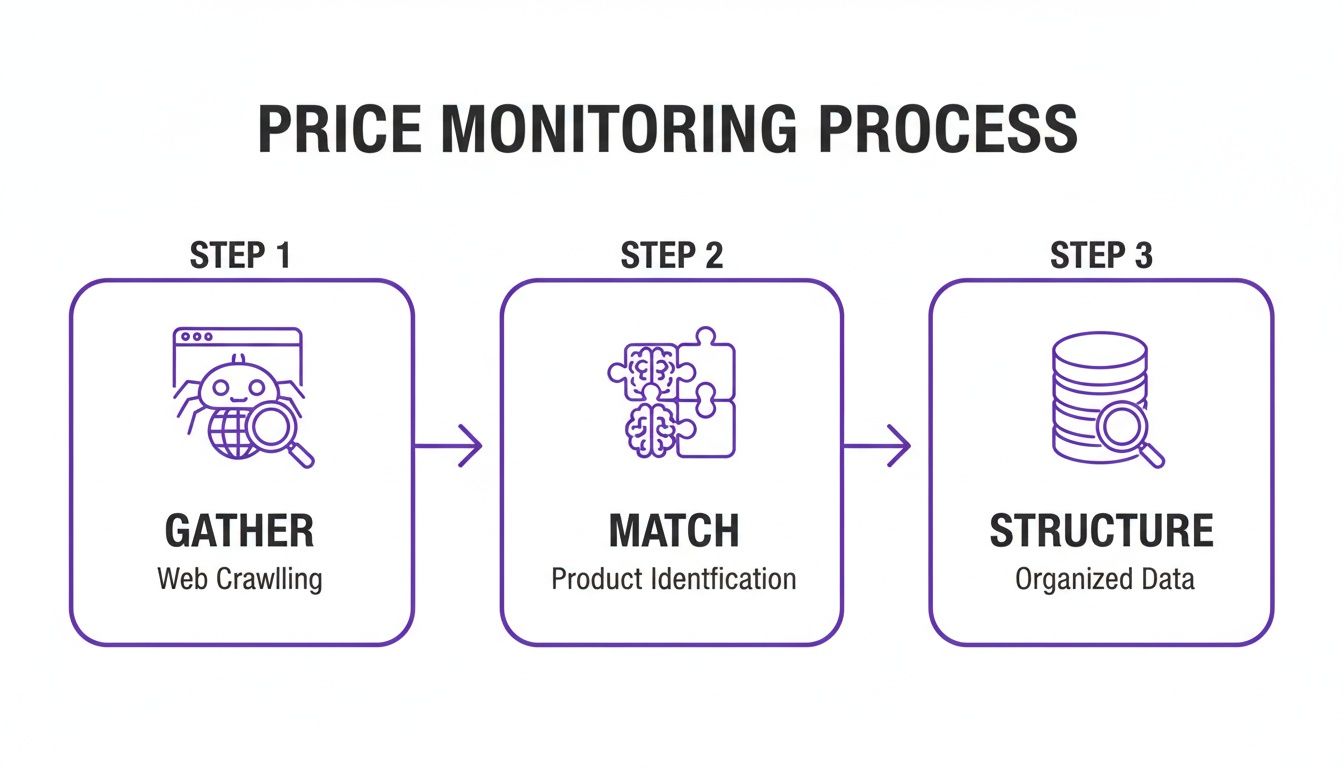

Understanding the core mechanics of price monitoring helps decision-makers trust the data that informs their strategy. The process is a logical, three-step workflow that transforms messy public web data into structured, actionable business intelligence.

The technology hinges on three key stages: gathering the data, matching the products, and structuring the output for analysis.

Step 1: Data Gathering with Web Crawlers

The process begins with collecting public data. This is done by automated programs known as web crawlers (or "spiders"). These crawlers are configured to visit competitor websites, marketplaces like Amazon, and price comparison engines.

They systematically navigate these sites to extract specific data points, including:

- Product Price: List price, sale price, and any visible promotional discounts.

- Stock Availability: In-stock status, low stock warnings, or out-of-stock notices.

- Shipping Costs: Fees and delivery timelines that contribute to the total customer cost.

- Seller Information: On marketplaces, this is critical for tracking authorized and unauthorized sellers.

While a human could check a few dozen products per hour, a distributed web crawling infrastructure can scan millions of pages daily, providing a comprehensive and continuous view of the market.

Step 2: Product Matching with AI

With raw data collected, the most critical step is product matching. It is essential to ensure that a price comparison is for the exact same product. Comparing your premium model to a competitor's entry-level version leads to flawed analysis and poor business decisions.

Without accurate product matching, the collected data is commercially useless. It is the equivalent of having a list of phone numbers with no names attached.

Advanced monitoring systems use a hybrid approach to achieve high accuracy:

- Product Identifiers: The system first looks for universal codes like SKUs, UPCs, or EANs for a direct match.

- Textual Analysis: When identifiers are absent, AI algorithms analyze product titles, model numbers, and descriptions to find statistical similarities.

- Image Recognition: Sophisticated systems visually compare product images to identify identical items, even if photos have different angles or lighting.

This multi-layered technique enables leading platforms to achieve over 99% matching accuracy, turning a simple price scraper into a reliable competitive intelligence tool. You can learn more about how to evaluate different ecommerce price monitoring tools and their matching capabilities.

Step 3: Data Structuring and Delivery

The final step is to clean and organize the millions of raw data points. Crawled data is often unstructured—prices may include different currency symbols, and stock availability can be described in dozens of ways ("Available," "In Stock," "Only 2 Left!").

Data structuring standardizes this information into a clean database, making it ready for analysis. Instead of delivering a raw data file, a dedicated retail price monitoring platform like Market Edge presents this information in intuitive dashboards and reports. This allows users to filter, compare, and identify trends without requiring a data science background, turning raw data into actionable insights for MAP enforcement, competitive benchmarking, and strategic planning.

How to Use Price Monitoring Data in Your Business

Access to clean, organized pricing data allows a business to shift from a defensive, reactive posture to a proactive strategy that drives growth. The true value is realized when this data is applied to solve specific commercial challenges.

The process is a repeatable loop: crawlers gather data, AI matches products, and the system delivers structured insights that inform action.

This methodical flow ensures decisions are based on a solid foundation of market intelligence, turning internet noise into a valuable strategic asset.

Enforce MAP and RRP Compliance

For brands, protecting brand equity is paramount. When sellers disregard your Minimum Advertised Price (MAP) or Recommended Retail Price (RRP) policies, it not only devalues your products but also damages relationships with compliant retail partners.

Automated price monitoring is the only efficient way to enforce these policies at scale. When a violation occurs, the system provides:

- Immediate Alerts: Notifications detailing the seller, product, price, and time of the violation.

- Documented Evidence: Time-stamped screenshots and pricing logs create an airtight record for enforcement actions.

- Streamlined Workflow: This proof can be automatically routed to the appropriate teams to initiate the remediation process.

Mini Use Case: A high-end headphone brand uses automated monitoring to watch 200 online retailers. The system flags a new, unauthorized seller on a marketplace offering a 15% discount. An alert, complete with a screenshot, is instantly sent to the brand's legal team. Within hours, they contact the marketplace and have the listing pulled—protecting their pricing and their authorized partners.

Sharpen Competitive Benchmarking

Without hard data, understanding your market position is guesswork. Competitive benchmarking uses structured pricing data to provide a clear, quantitative view of your pricing relative to competitors.

This enables you to identify where your products may be priced too high, leading to lost sales, or too low, sacrificing margin unnecessarily. By tracking your Price Index—a metric comparing your prices to a key competitor or the market average—you can make precise, data-backed adjustments.

The commercial stakes are high. With core U.S. retail sales growing consistently, as tracked by the CNBC/NRF Retail Monitor, optimized pricing is essential to capture market share. For brand owners, this means immediate detection of even a 5% MAP violation is critical to prevent margin erosion.

Protect and Grow Profit Margins

In crowded markets, the temptation to engage in a "race to the bottom" on price is strong, but it is a strategy that erodes profitability for everyone. Price monitoring provides the context behind a competitor's price change, allowing for a more strategic response.

Instead of a knee-jerk price match, you can analyze the situation. Is the competitor about to run out of stock? Is this a limited-time flash sale? Do they have high shipping costs that offset the low price? This intelligence allows you to confidently hold your price when appropriate or make a calculated adjustment that balances market share and profitability.

Unlock Smarter Sourcing Opportunities

Price monitoring is a powerful tool for procurement and supply chain teams. By monitoring the stock levels and pricing of key suppliers or competitors, you can identify strategic sourcing advantages.

For example, if a primary competitor is consistently out of stock on a popular product, it may indicate a supply chain vulnerability. This presents an opportunity for your business to secure additional inventory and capture that unmet demand, potentially at a higher margin.

Building Your Price Monitoring Strategy Step by Step

An effective price monitoring program requires more than just technology; it requires a clear plan to convert data into business results. Without a strategy, you risk "analysis paralysis"—drowning in data without a clear path to action.

This practical, four-step framework provides a blueprint for building a system that drives smarter, faster commercial decisions.

Step 1: Define Your Goals and KPIs

Begin by defining what success looks like. A vague goal like "track competitors" is insufficient. Your objectives should be specific, measurable, and tied to a core business problem, such as margin erosion, loss of market share, or brand dilution from MAP violations.

Once the problem is defined, establish clear Key Performance Indicators (KPIs) to measure progress:

- MAP Compliance Rate: The percentage of resellers adhering to your MAP policy. A typical goal is to increase this from 80% to over 95% within a quarter.

- Price Index: A score comparing your prices against a key competitor or the market average (e.g., a score of 105 means you are 5% more expensive). The goal might be to maintain an index of 102 on premium products while achieving 98 on promotional items.

- Time to Detect: The time it takes to identify a critical competitor price change or stockout. The objective is to reduce this from days to minutes.

- Margin Impact: The measurable change in gross margin resulting from data-driven pricing adjustments. This is the ultimate proof of ROI.

Step 2: Identify Key Competitors and Products

Avoid the common mistake of trying to monitor everything at once. This creates excessive noise and makes it difficult to focus on what matters. A more effective approach is to start with a targeted scope.

Prioritize your efforts by focusing on:

- Direct Competitors: The 3-5 rivals selling similar products to the same customer base.

- Aspirational Competitors: Market leaders whose pricing strategies can provide valuable insights.

- High-Impact SKUs: Your best-selling products, items with the highest margins, or strategic new launches where pricing accuracy is critical.

This focused approach ensures you act on the most important intelligence first. You can expand your scope as your processes mature.

Step 3: Configure Your Monitoring Platform

With clear goals and targets, configure your monitoring platform to act as an early-warning system. This involves setting up custom rules and alerts tied directly to your KPIs.

- Price Change Alerts: Notify the pricing manager when a key competitor drops the price on a top-selling SKU by more than 5%.

- Stockout Alerts: Send an alert to the sales and marketing teams when a competitor runs out of stock on a product you carry. This is an immediate sales opportunity.

- MAP Violation Alerts: Route notifications of MAP breaches directly to the compliance or legal team for immediate action.

Proactive alerting is essential during peak shopping seasons. The recent holiday season saw over $257.8 billion in U.S. online sales, according to Adobe's holiday shopping report, driven by dynamic pricing. During these periods, an automated platform like Market Edge uses AI-matched SKU data to provide an instant snapshot of your market position, allowing you to react decisively.

Step 4: Integrate Data into Your Workflow

Pricing intelligence is most valuable when it is integrated into the daily routines and systems of the people who can act on it.

- ERP Integration: Feed pricing data into your Enterprise Resource Planning system to compare competitor prices against your cost of goods and margin thresholds.

- BI Tool Integration: Push data into business intelligence platforms like Tableau or Power BI for deeper, long-term trend analysis.

- Communication Channel Integration: Set up alerts that deliver critical notifications directly into team communication channels like Slack or email.

By embedding this data into your company's existing workflows, price monitoring becomes a natural part of the decision-making process. This is where automated price monitoring tools like Market Edge become useful, making data accessible and actionable across the organization.

Common Price Monitoring Pitfalls and How to Avoid Them

Implementing a price monitoring program can be a game-changer, but several common strategic mistakes can hinder success. These pitfalls are preventable with proper planning.

Pitfall 1: Tracking Everything at Once

The impulse to monitor every product against every competitor from day one is a recipe for data overload. This "boil the ocean" approach creates so much noise that critical signals—like a major competitor stocking out of a key item—are lost.

Solution: Start with a focused pilot. Select one key product category and your top 3-5 direct competitors. Use this smaller scope to establish a workflow, prove the value, and secure early wins before scaling the program.

Pitfall 2: Relying on Inaccurate Data

Your pricing strategy is only as good as the data it is built on. If your monitoring tool has poor product matching accuracy, you risk making decisions based on flawed comparisons (e.g., matching your premium SKU against a competitor's budget version). This not only leads to bad decisions but also erodes the team's trust in the data.

How to Ensure Data Quality:

- Verify Matching Methodology: Choose a provider that uses a hybrid of SKUs, EANs, image recognition, and attribute analysis for matching.

- Request a Data Audit: Before committing, ask for a sample data audit on a subset of your products to manually verify matching accuracy.

- Look for Confidence Scores: Advanced platforms like Market Edge often provide a confidence score for each product match, allowing you to filter for only the most reliable data.

Pitfall 3: Siloing the Intelligence

A frequent failure is confining pricing intelligence to a single department. When the pricing team has critical insights—such as competitor stockouts or MAP violations—that are not shared, the rest of the organization misses opportunities. The sales team cannot capitalize on a competitor's inventory issue, and the marketing team cannot counter a rival's promotion.

Actionable Checklist to Break Down Silos:

- Weekly Insights Huddle: Conduct a brief 15-minute meeting with sales, marketing, and procurement leads to share the top 2-3 market insights from the past week.

- Role-Specific Alerts: Configure your platform to send alerts to the relevant teams (e.g., stockout alerts to sales, MAP violations to the brand manager).

- Integrate with Shared Tools: Pipe pricing data into systems the entire organization already uses, such as a central CRM or BI dashboard.

Choosing The Right Price Monitoring Partner

Selecting a technology partner is as critical as the strategy itself. The right tool provides reliable data and empowers your team, while the wrong one can create frustration with inaccurate data and poor usability. The goal is to find a solution that aligns with your business objectives.

Key Evaluation Criteria

Focus your evaluation on these four critical areas:

- Data Accuracy and Product Matching: This is the foundation. Ask potential vendors to detail their product matching process. Can they handle products without universal identifiers using image recognition and attribute analysis? A matching accuracy rate below 99% for identifiable products is a significant red flag.

- Scalability and Performance: The platform must be able to grow with your business. Can it scale from tracking 1,000 SKUs to 100,000 without a drop in performance? How frequently is the data refreshed—daily, hourly, or near real-time? The answer determines your ability to react to market changes.

- Customization and Reporting: A one-size-fits-all dashboard is insufficient. The tool should allow you to build custom reports, configure role-specific alerts (e.g., for MAP compliance vs. competitive benchmarking), and analyze data in a way that maps to your business structure.

- Integration and API Access: Pricing data becomes exponentially more powerful when connected to other business systems. Verify that the vendor offers a robust, well-documented API to integrate with your ERP, BI tools, or dynamic pricing engine.

Takeaway: Choosing a vendor is a long-term partnership. Prioritize providers who demonstrate a deep understanding of your industry and offer dedicated support to help translate data into strategy. A tool is only as good as the team helping you use it effectively.

If you are currently evaluating options, our guide to the best price monitoring software provides a deeper comparison of leading solutions.

Vendor Selection Checklist for Price Monitoring Tools

Use this checklist to structure your conversations with potential vendors and ensure you cover all critical requirements.

| Evaluation Criteria | Key Questions to Ask | Importance (High/Medium/Low) |

|---|---|---|

| Data Accuracy | What is your guaranteed product matching accuracy rate? How do you handle products without UPCs/EANs? Can you provide a sample data audit? | High |

| Data Freshness | How often is the pricing data refreshed (real-time, hourly, daily)? Can we increase the frequency for specific products or competitors? | High |

| Scalability | What is the maximum number of SKUs and competitors the platform can handle? How does performance change as we scale? | High |

| Integration | Do you have a well-documented API? What pre-built integrations do you offer (e.g., Shopify, BI tools)? Is API access included or extra? | High |

| Customization | Can we build custom dashboards and reports? Are alerts and notifications customizable by user role or trigger? | Medium |

| User Experience | Is the interface intuitive? Can we get a live demo or a trial account to test it with our own data? | Medium |

| Support | What does your customer support model look like? Do we get a dedicated account manager? What are the standard response times? | High |

| Pricing Model | How is pricing structured (per SKU, per competitor, flat fee)? Are there any hidden costs for setup, training, or support? | Medium |

| Roadmap | What new features are on your product roadmap for the next 6-12 months? How do you incorporate customer feedback into development? | Low |

This systematic approach helps you look beyond marketing claims to identify a partner that can deliver true strategic value.

Common Questions About Price Monitoring Answered

Here are answers to common questions from business leaders evaluating price monitoring for the first time.

How Often Should We Be Checking Prices?

The ideal frequency depends on your market's velocity. For highly dynamic categories like consumer electronics or fast fashion, where prices can change multiple times per day, daily or near real-time monitoring is necessary to remain competitive. For industries with longer sales cycles or more stable B2B pricing, a weekly refresh may be sufficient. The goal is to match the monitoring frequency to the rhythm of your market.

Is It Legal to Monitor Competitor Prices?

Yes, monitoring prices on publicly available websites is 100% legal. The software automates the process of collecting public information that any customer could access by visiting a competitor's website. It is not covert surveillance; it is the aggregation of public data for strategic analysis.

How Do You Handle Products Without a SKU Match?

This is a common challenge, as many online listings lack universal identifiers. Advanced price monitoring platforms solve this by using a multi-layered, AI-powered approach beyond simple code matching. These systems analyze:

- Product titles and model numbers

- Key attributes and phrases in product descriptions

- Image recognition to visually compare products

By combining these signals, a robust system can accurately identify identical products even without a shared barcode, ensuring you are always making true apples-to-apples comparisons. Platforms like Market Edge are designed to handle this complexity out of the box.

This is where automated price monitoring tools like Market Edge become useful. Learn how you can protect your margins and enforce MAP with accurate, real-time data.