To meaningfully increase retail sales, leadership must move from reactive guesswork to proactive analysis. The most effective growth strategies are built on a precise combination of strategic pricing, optimized product assortment, and a superior customer experience. This process begins with a clear-eyed audit of current performance.

Audit Your Sales Performance to Identify Growth Levers

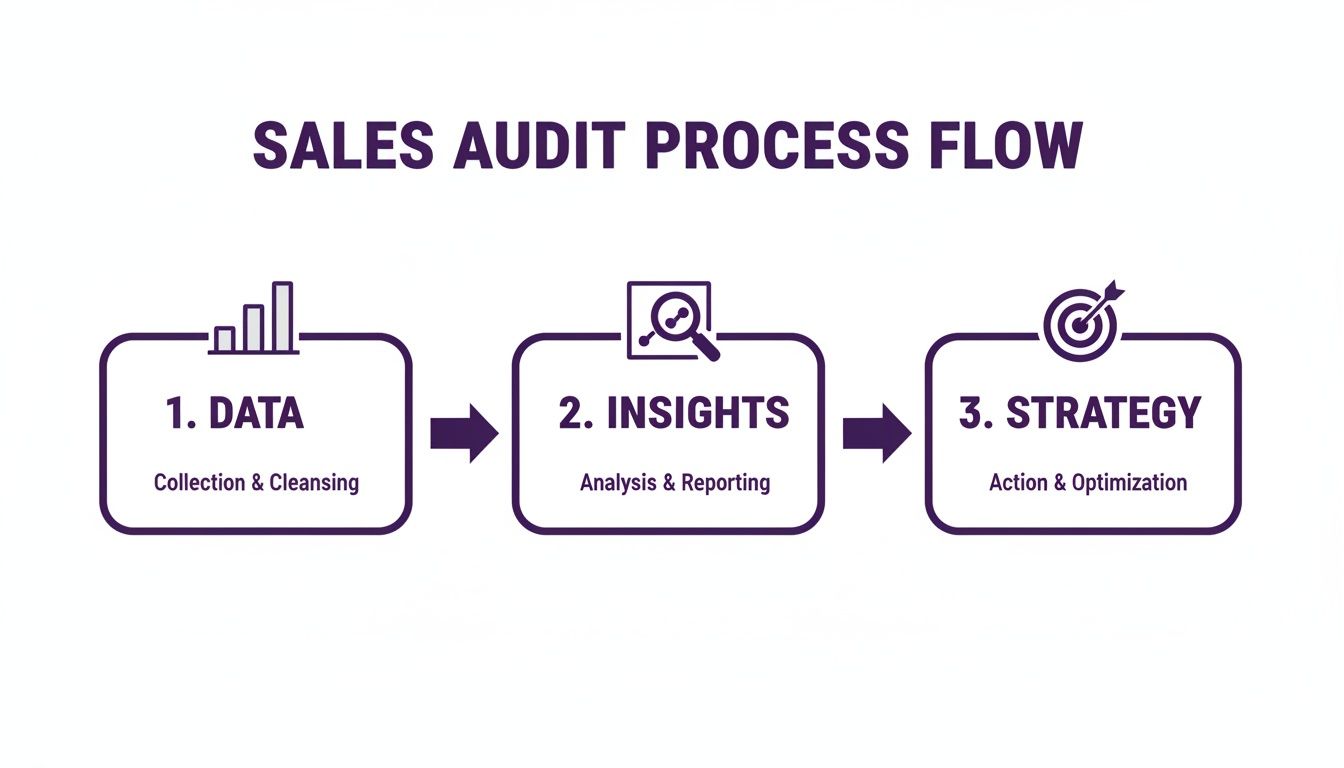

Before developing a growth strategy, establishing a clear performance baseline is essential. A comprehensive sales audit must go beyond top-line revenue to analyze the specific products, channels, and campaigns driving results versus those consuming resources inefficiently.

This diagnostic phase is critical for ensuring that strategic initiatives are targeted and impactful. The objective is to shift from broad inquiries like, "How can we sell more?" to specific, data-driven questions such as, "Why is our conversion rate on Amazon 15% lower for Category X compared to our direct-to-consumer channel?"

Segmenting Sales Data for Actionable Insights

To uncover opportunities, segmenting sales data from multiple perspectives is necessary. This deep dive will immediately clarify where to direct strategic attention.

-

By Channel: Compare the performance of your direct-to-consumer website against marketplaces like Amazon or eBay and physical stores. Analyze key metrics: sales volume, conversion rates, and average order value (AOV) for each. This analysis reveals which channels are primary revenue drivers and which hold untapped potential.

-

By Product Category: Identify which categories generate the most revenue and profit. A high-revenue category with thin margins may indicate intense price competition. Conversely, a niche, high-margin category could represent a valuable target for focused marketing investment.

-

By SKU: Drill down to the individual product level. Pinpoint bestsellers—the core drivers of your business—and identify slow-moving products that tie up capital and warehouse space. This analysis is fundamental for making informed inventory and merchandising decisions.

A common strategic error is focusing solely on hero products while neglecting the long tail of underperforming SKUs. These items generate hidden carrying costs that erode overall profitability. A disciplined audit provides the data needed to delist them and reallocate resources toward higher-impact initiatives.

Identifying Key Growth Pillars

After completing the analysis, the data will reveal clear patterns and opportunities. These findings typically align with three core pillars that form the foundation of any modern retail growth strategy.

The granular data from a sales audit provides the "why" behind current performance, which is essential for building a robust market analysis. For a deeper examination of that process, we offer guidance on how to conduct a market analysis in a separate article.

This analytical foundation distinguishes a proactive growth plan from a reactive one. It transforms raw sales figures into a strategic roadmap that informs every subsequent decision. Automated platforms, such as Market Edge Monitoring, are instrumental in gathering the clean, consistent data required for such an audit.

Mastering Your Pricing Strategy to Drive Revenue

Following a performance audit, pricing is the most powerful and immediate lever for increasing sales. Many businesses still rely on outdated cost-plus models, leaving significant revenue opportunities unrealized.

An effective pricing strategy is not a one-time task but an ongoing discipline. It requires sharp competitive intelligence and a clear understanding of your market position. Moving beyond simple markups means using price as a strategic tool to communicate brand value and competitive differentiation. Operating without visibility into competitor pricing is a significant strategic risk.

This is the basic flow: turn raw market data into a real, revenue-boosting strategy.

This visual breaks down the essential path—from capturing competitor data to deriving insights that directly shape pricing and promotional strategies.

Key Pricing Strategies and Their Impact on Sales

The selection of a pricing strategy should align with specific business goals, whether entering a new market, liquidating inventory, or establishing a premium brand position. The table below outlines common approaches and their expected outcomes.

| Pricing Strategy | Primary Goal | Potential Sales Impact | Best For |

|---|---|---|---|

| Competitive Pricing | Stay aligned with or just below market leaders | Stable market share; can lead to price wars if not managed carefully | Saturated markets with little product differentiation. |

| Value-Based Pricing | Align price with the perceived value to the customer | Higher margins and stronger brand loyalty, but requires deep customer insight | Unique or highly differentiated products with a strong value proposition. |

| Dynamic Pricing | Adjust prices in real-time based on demand and competition | Maximizes revenue per sale; can increase overall sales volume by capitalizing on trends | E-commerce, travel, and industries with fluctuating demand. |

| Penetration Pricing | Set a low initial price to capture market share quickly | High initial sales volume, but can devalue the brand if not raised later | New product launches or market entries. |

| MAP Enforcement | Maintain brand value and price integrity across all channels | Protects margins for all sellers, fostering retailer loyalty and brand health | Brands selling through third-party distributors and retailers. |

In practice, a hybrid approach often yields the best results. For example, a business might use competitive pricing for core products while applying value-based principles to a new, innovative offering.

Building a Competitive Pricing Framework

A robust pricing strategy is built on data. A systematic process for tracking competitor actions is essential for making informed decisions—whether that involves a price increase or a tactical reduction.

Here’s a practical workflow to get started:

- Identify Direct Competitors: Pinpoint retailers selling identical or highly similar SKUs. This analysis should include major marketplaces as well as smaller, niche competitors.

- Automate Intelligence Gathering: Manual price checking is inefficient and prone to error. An automated price monitoring tool can track prices, stock levels, and promotions across your entire catalog, providing clean data without manual effort.

- Analyze and Act: Use the data to benchmark your position. Are you consistently overpriced, or are you priced significantly below the market, indicating an opportunity to increase prices and improve margins? Configure alerts for significant price movements to enable rapid response.

Use Case: A distributor of electronic components uses a competitor tracking platform and discovers they are consistently 15% more expensive than a key rival on a best-selling processor. Without this intelligence, they would only see declining sales. With it, they can implement a precise price adjustment to regain market share. This is a direct example of how to increase retail sales using price intelligence.

The Critical Role of MAP Enforcement

For brands and manufacturers, a pricing strategy must extend beyond proprietary channels to protect brand value across the entire retail ecosystem. Minimum Advertised Price (MAP) enforcement is critical to this effort.

When third-party sellers violate a MAP policy by advertising products below the established threshold, they trigger a race to the bottom. This price erosion diminishes the brand's perceived value and penalizes compliant retail partners.

An unenforced MAP policy is more detrimental than having no policy at all. It signals to the market that pricing is arbitrary, devaluing products and straining relationships with compliant retailers who are unfairly undercut.

Effective MAP enforcement requires continuous monitoring of online marketplaces and reseller websites. Automated tools can scan for violations, capture evidence, and streamline the notification process. This proactive stance is crucial for maintaining the price integrity that underpins long-term brand health and sales stability.

Market context underscores this urgency. With global retail sales projected to hit $31.3 trillion in 2025 and e-commerce forecasted to capture nearly 24% of that spend, online price visibility is paramount. Retailers using real-time price monitoring to benchmark against competitors and enforce MAP have reported sales increases of 15-20% by preventing price-driven customer attrition.

An adaptive pricing model allows you to respond to market shifts in near real-time. For a deeper dive, check out our guide on implementing dynamic pricing in retail. This is where automated price monitoring tools prove their strategic value.

Optimizing Your Product Merchandising and Assortment

Even with a perfectly executed pricing strategy, sales depend on offering products that meet customer demand. An effective product assortment is a curated collection that balances market needs with business profitability. Strong merchandising—the presentation of those products—is what captures shopper attention and drives conversion.

The key is to replace assumptions with data. Leading retailers combine internal sales analytics with external market intelligence to build a product catalog that is optimized for performance.

Analyzing Competitor Assortments to Find Gaps

A systematic analysis of competitor product catalogs is an effective method for refining your own. This intelligence can reveal emerging trends, highlight high-demand categories you may be overlooking, and identify market gaps.

Key areas of focus include:

- New Product Introductions: Are competitors launching new items in a category where your offerings are stagnant? This often signals a shift in consumer preferences.

- Category Depth and Breadth: Compare the number of brands and SKUs they carry in your core categories. A significantly wider selection may indicate they are capturing a broader customer base.

- Discontinued Items: A competitor delisting a product can signal poor performance or a supply chain issue, potentially creating an opportunity for you to fill the void.

This analysis is not about imitation but about strategic positioning. For example, if a rival stocks ten premium brands in a category where you offer only two, you are likely missing an opportunity for high-margin sales.

Leveraging Stock Availability for a Competitive Edge

While competitor price tracking is common, monitoring their stock levels can provide a significant competitive advantage. When a competitor is consistently out of stock on a popular product, it represents a direct opportunity to capture market share.

A competitor’s stockout is a clear signal of unmet demand. If you have the product available and priced appropriately, you can absorb that demand and acquire new customers who might otherwise have never considered your business.

This is where automated competitor tracking becomes a core operational asset. Use Case: An importer of specialty tools uses an ecommerce monitoring platform and sees that their primary online competitor is frequently sold out of a best-selling wrench set. Armed with this data, the purchasing manager can confidently increase the next order for that SKU. Simultaneously, the marketing team can launch targeted digital ads for that specific product, capturing frustrated buyers at their moment of need.

This workflow transforms passive monitoring into an active sales-generation engine. Platforms like Market Edge provide near real-time alerts on competitor stock levels, enabling purchasing and sales teams to make agile decisions that directly increase sales.

Improving the Digital Shelf Experience

Once the product assortment is optimized, its presentation is critical. Online merchandising is the digital equivalent of a physical storefront and must be equally compelling. Small improvements in this area can yield significant increases in conversion rates.

Focus on these three key areas:

- High-Quality Imagery and Video: Since customers cannot physically interact with the product, visual assets must convey quality and features. Use multiple high-resolution photos and consider adding short videos demonstrating the product in use.

- Compelling and Clear Product Descriptions: Go beyond manufacturer specifications. Write unique, benefit-oriented copy that answers common customer questions. Use bullet points for scannability.

- Logical Product Categorization and Filtering: A website with intuitive navigation and robust filtering options (e.g., by size, color, brand, price) reduces friction and prevents site abandonment.

Optimizing assortment and merchandising directly improves inventory efficiency. To understand this relationship better, you can learn more about the inventory turnover ratio in our detailed guide.

Enhance the Customer Experience to Build Real Loyalty

Acquiring customers through competitive pricing and an optimal product assortment is only the first step. Sustainable growth is achieved by creating a seamless and trustworthy experience that converts first-time buyers into long-term partners.

Every customer touchpoint contributes to their perception of your brand, from initial website interaction to the checkout process and post-purchase support. For B2B decision-makers, mastering this journey is the most direct path to increasing customer lifetime value (CLV) and driving bottom-line growth. The goal is to identify and eliminate friction at every stage.

Build Trust Through Price Transparency

Today’s customers can compare prices across multiple sites in seconds, making price transparency a foundational element of trust. A price discrepancy between your website and a marketplace like Amazon instantly erodes credibility.

This is where market data becomes a customer experience tool. By consistently monitoring competitor pricing, you can ensure your own prices are fair and competitive. This allows you to defend your value proposition with data, demonstrating reliability and respect for your customers' business.

Smooth Out the Path to Purchase

Friction is the primary cause of abandoned carts and lost online sales. A complicated checkout process, confusing site navigation, or unexpected shipping fees will deter customers. A non-negotiable priority is to make it as easy as possible for users to find and purchase products.

- Sharpen Your Site Navigation: Ensure product categories are intuitive and the search function is effective. A customer should be able to locate any product within three clicks.

- Simplify Your Checkout: Eliminate unnecessary form fields. Offer a guest checkout option and provide multiple payment methods (e.g., PayPal, Apple Pay, credit cards).

- Be There to Help: Offer support channels like live chat or a clearly visible phone number to provide quick answers and overcome purchase barriers.

A complex checkout is the digital equivalent of a long queue at a physical store. Each additional step required of a customer increases the likelihood of abandonment. Data consistently shows that simplifying this workflow is one of the highest-impact changes for improving conversion rates.

Walk a Mile in Your Customer’s Shoes

The most effective way to identify friction points is to experience them directly. A regular customer journey audit is essential for uncovering hidden obstacles that are costing you sales.

This involves methodically mapping every step a customer takes, from discovery to a potential return.

- Discovery: How do customers find you? Review search engine results, social media presence, and marketplace listings. Is the brand messaging consistent?

- Consideration: Once on your site, how easy is it to compare products? Are descriptions, specifications, and images clear and sufficient?

- Purchase: Place an order on your own store. Was any part of the checkout process unclear? Were all costs, including shipping and taxes, presented upfront?

- Post-Purchase: What is the experience after the order is placed? Are confirmation and shipping notifications timely? Is the returns process straightforward?

This exercise invariably reveals areas for improvement. These are not minor tweaks; they directly impact customer perception and loyalty, driving both immediate sales and long-term growth. As U.S. retail sales continue to grow, the brands that master the customer experience will be the ones that win. We've seen brands that use near real-time data to benchmark products and maintain price integrity see a direct conversion lift of 10-15%. You can read the full research about total retail sales trends to see the bigger picture.

This is where automated price monitoring tools like Market Edge become invaluable.

Measuring Your Results and Refining Your Approach

Launching a new sales strategy is the beginning, not the end. The critical work involves tracking performance, diagnosing issues, and refining the approach. Without a rigorous feedback loop, resource allocation is based on conjecture, potentially funding ineffective tactics while overlooking high-potential opportunities.

This final component is where raw performance data is transformed into a sustainable competitive advantage. It is about fostering a culture of continuous learning, adaptation, and optimization.

Building Your Retail Performance Dashboard

A centralized source of truth is essential for clear performance visibility. A well-designed dashboard that tracks relevant Key Performance Indicators (KPIs) is non-negotiable. This enables a shift from vanity metrics, like raw website traffic, to the data points that directly reflect business health.

While specific KPIs vary, a core dashboard should include:

- Conversion Rate: The ultimate measure of effectiveness, reflecting how well pricing, merchandising, and customer experience are working in concert to convert visitors into buyers.

- Average Order Value (AOV): A direct measure of the effectiveness of upselling, cross-selling, and product bundling strategies.

- Customer Lifetime Value (CLV): A long-term metric that tracks the total revenue generated from a single customer over time, serving as the definitive measure of loyalty and customer experience success.

- Gross Margin: This ensures that sales growth is profitable and that pricing strategies are not sacrificing the bottom line for top-line revenue.

Monitoring these KPIs in near real-time allows for the early detection of trends and issues. For instance, a sudden drop in AOV could signal a problem with a "related products" algorithm or a new, aggressive bundle offer from a competitor that requires a response.

Establishing a "Test-and-Learn" Methodology

With a solid measurement framework in place, you can begin structured experimentation. A/B testing provides a quantitative method for comparing a new initiative against a control version to determine which performs better.

This disciplined approach removes subjectivity from key decisions. Instead of debating the potential success of a new pricing model, you can test it on a small audience segment and let the data provide a conclusive answer.

A common error is testing multiple variables simultaneously. If you change a product’s price, hero image, and description, it is impossible to attribute the outcome to a single change. Effective A/B testing requires isolating a single variable to measure its specific impact.

Using Market Data to Sharpen Your Strategy

Internal metrics provide a clear view of your own performance but lack external context. Ongoing competitor and marketplace monitoring is critical for a complete picture. Integrating external market data into regular strategic reviews enables a proactive, rather than reactive, approach.

The growth of e-commerce illustrates this point: it captured 20.1% of all retail sales in 2024, up from 16% in 2019, and is projected to reach 22.6% by 2027. Retailers actively monitoring these dynamics are best positioned to capture this growing market share. Use Case: An e-commerce brand receives an automated alert about a competitor's stockout or a significant price mismatch on a key marketplace. This allows them to reprice immediately to capture that demand. You can dig deeper into these online retail trends and their business implications.

A best practice is to schedule regular strategy sessions where teams analyze both the internal performance dashboard and the latest external market intelligence.

An Actionable Checklist for Your Strategy Huddle

Here is a simple checklist for a weekly or bi-weekly review:

- Review Core KPIs: How do our Conversion Rate, AOV, and Gross Margin compare to the previous period and the same period last year?

- Analyze Competitor Pricing: Have any key competitors made significant price changes? How has this impacted our sales for those SKUs?

- Check Competitor Stock: Is a top-selling competitor product out of stock? Can we capitalize on this with a targeted promotion?

- Evaluate Recent Tests: What were the results of our last A/B test? What was learned, and what is the next logical experiment?

This continuous cycle of measurement, testing, and adaptation is what distinguishes market leaders. This is where automated price monitoring tools like Market Edge provide a significant competitive advantage.

Frequently Asked Questions

When managing retail operations to drive growth, several common questions arise. Here are answers to some of the most frequent inquiries from ecommerce managers and brand leaders.

What Is the Single Most Effective Way to Quickly Increase Online Retail Sales?

While a comprehensive strategy is essential for long-term growth, the most immediate lever is strategic pricing based on real-time competitive data.

Implementing an automated system to monitor competitor prices provides an up-to-the-minute view of the market, allowing you to identify and act on opportunities instantly. For example, if automated tracking identifies that your price for a key product is 15% higher than the market average, a data-informed price reduction can immediately improve your conversion rate. Conversely, if you are priced significantly lower than competitors, you may have an opportunity to increase your price and margin without losing competitive positioning. Automation is key; manual tracking is not scalable or timely enough.

How Can I Increase Retail sales Without Discounting?

This question addresses sustainable growth. Over-reliance on discounts can erode margins and devalue a brand. The alternative is to focus on increasing perceived value.

Here are several effective strategies:

- Curate a Superior Product Assortment: Analyze sales data to identify top-performing products and increase investment in them. Simultaneously, monitor competitor stock levels to identify and fill gaps in the market.

- Optimize Online Merchandising: High-quality imagery, detailed product descriptions that anticipate customer questions, and prominent customer reviews all build the confidence required for a purchase decision.

- Enforce Your MAP Policy: For brands, this is non-negotiable. A consistently enforced Minimum Advertised Price (MAP) policy prevents unauthorized resellers from devaluing your products online, which protects brand integrity and supports your authorized retail partners.

Many businesses default to price reductions as their primary growth tactic. However, durable growth comes from a value proposition that extends beyond being the cheapest option. It is about offering the right product, presenting it effectively, and building a trustworthy brand.

What Key Metrics Should I Track to Measure Sales Initiatives?

To accurately measure the impact of your efforts, focus on a core set of performance indicators rather than getting lost in excessive data.

These are the essential metrics for any retail performance dashboard:

- Conversion Rate: The ultimate indicator of performance, reflecting how effectively your pricing, merchandising, and user experience work together to convert visitors.

- Average Order Value (AOV): Measures the effectiveness of upselling, cross-selling, and bundling initiatives.

- Customer Lifetime Value (CLV): A long-term metric that indicates whether you are building customer loyalty or merely acquiring transactional buyers.

- Gross Margin: A crucial reality check that ensures sales growth is profitable and not driven by margin-eroding promotions.

How Often Should I Adjust My Product Prices?

The answer is situational. In highly competitive categories on marketplaces like Amazon, repricing may be required multiple times per day. For brands in more stable markets, a weekly review may suffice.

The guiding principle should not be a fixed schedule but a data-driven one. A continuous price monitoring system should serve as the trigger for adjustments. Prices should be changed in response to market events, not based on the calendar. For instance, an alert that a top competitor is out of stock on a key product presents an immediate opportunity to adjust your strategy. This is where tools like Market Edge shift your posture from reactive to proactive.

By centralizing competitive intelligence, Market Edge helps you set smarter prices, enforce your brand's value, and win more deals in a crowded market. Learn more about our automated price monitoring solution.