Pricing products for retail requires a calculated balance between internal costs, market position, and customer value perception. An effective strategy integrates three core disciplines: calculating the true cost of goods sold, analyzing competitive intelligence, and defining a sustainable profit margin. This approach ensures your pricing is both competitive and profitable.

Rethinking Retail Pricing in a Dynamic Market

In the current retail environment, a static pricing model is a direct path to margin erosion and market share loss. The traditional practice of setting a price and reviewing it annually is obsolete. Today's market demands a more agile, data-informed strategy to maintain a competitive edge.

Business leaders face pressure from multiple fronts, making intelligent pricing more critical than ever. Intense online competition allows a customer to compare your price against a dozen others in seconds. Simultaneously, supply chain volatility turns your costs into a moving target, making it nearly impossible to protect margins without a responsive pricing framework.

The New Consumer Expectation

Modern shoppers are highly informed. They leverage apps, browser extensions, and instant access to information to find the best possible deal with minimal effort. This transparency compels businesses to justify every dollar on their price tag. The goal is not a race to the bottom but a clear demonstration of why your product is worth its price.

Pricing is a critical component of your brand narrative. It signals quality, market position, and the value you promise to customers. An inconsistent or unjustified pricing strategy can erode brand trust as quickly as a defective product.

The Commercial Stakes of Outdated Pricing

Adhering to a legacy pricing model while the market evolves is a significant commercial risk. The consequences directly impact the bottom line.

Here’s what you’re up against:

- Margin Erosion: If your costs increase or a competitor launches a major promotion and you fail to react, the difference comes directly out of your profit.

- Lost Market Share: Pricing too high drives customers to competitors. Pricing too low leaves revenue on the table and can devalue your brand's perception.

- Brand Devaluation: Constant, reactive sales promotions train customers to wait for discounts, eroding the perceived value of your products and harming long-term profitability.

A robust pricing strategy is not merely a defensive measure; it is a powerful offensive tool. It provides the framework to navigate market volatility with confidence. By maintaining a constant pulse on market dynamics, you can make informed decisions that protect margins and solidify your market position. This is where automated price monitoring tools, like Market Edge, become an indispensable part of your operational toolkit.

Choosing Your Core Product Pricing Model

To effectively price your products, you need a foundational model that aligns your pricing with your business objectives and market position. This framework provides structure and consistency.

While a hybrid approach is common, selecting a primary model is a critical first step. Most pricing strategies are built on one of three pillars: cost-plus, competitor-based, or value-based. Understanding which model to apply—and when—is fundamental to setting prices that are both profitable and competitive.

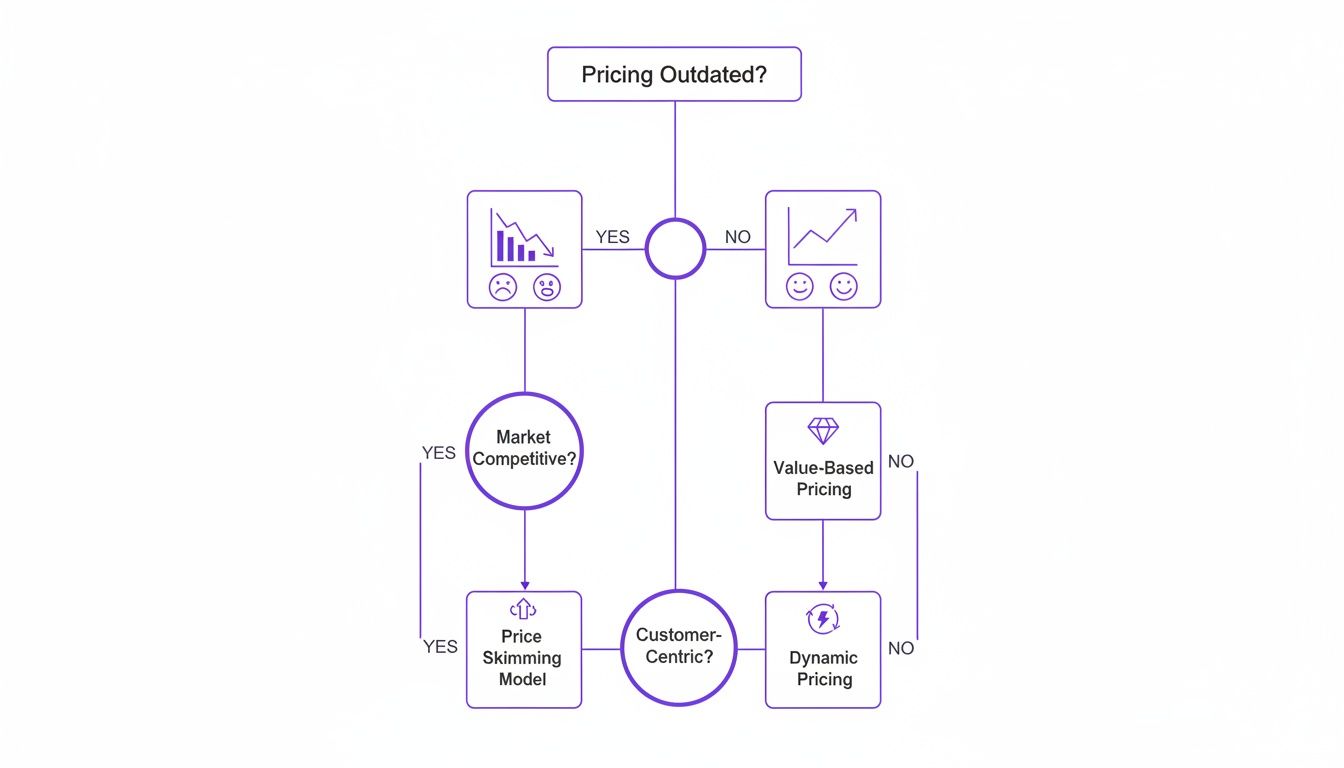

This decision tree illustrates how market awareness and customer focus separate reactive, legacy pricing from a proactive, modern strategy.

As the flowchart indicates, a business can either follow a path of internal focus and reaction or one of external awareness and proactivity. The latter leads to a more resilient and profitable pricing structure.

Cost-Plus Pricing: The Foundation

Cost-plus is the most direct pricing model. The formula is simple: Cost of Goods + Markup = Retail Price. This "inside-out" approach guarantees a specific profit margin on every sale, provided cost calculations are accurate.

This model is a common starting point for distributors and retailers due to its simplicity. It is easy to calculate and implement across thousands of SKUs, providing a reliable price floor that ensures every transaction contributes to the bottom line.

Mini Use Case: A Specialty Food Distributor A distributor imports a new line of olive oil. The landed cost per bottle—including shipping, tariffs, and warehousing—is $8.50. To meet their target margin, they apply a 100% markup ($8.50), setting their wholesale price at $17.00. Retailers then apply their own markup to this price.

- Pros: Simple to calculate, protects margins, and is easily scalable.

- Cons: Ignores market demand, competitor pricing, and perceived customer value. This can result in underpricing or overpricing relative to the market.

Competitor-Based Pricing: The Market-Aware Approach

This model uses competitor pricing as a primary benchmark. The objective is to position products by pricing them slightly below, slightly above, or at parity with key competitors. It is an externally focused model that requires continuous market monitoring.

This approach is essential in crowded, price-sensitive markets where customers have numerous alternatives. The goal is not simply to be the cheapest but to price strategically in relation to key competitors, reflecting your brand's unique value proposition.

A common error is to blindly match the lowest competitor price, which often initiates a race to the bottom that damages profitability for all players. Competitor data should be a key input, not the sole determinant of your price.

Executing this strategy effectively requires systematic competitor price tracking. Manual checks are inefficient and prone to error. This is why automated price monitoring tools are essential; they provide the data needed for strategic decisions rather than reactive price adjustments.

Value-Based Pricing: The Customer-Centric Ideal

Value-based pricing is the most sophisticated—and often most profitable—model. Instead of focusing on internal costs or external competitors, this model centers on the customer. The price is determined by the perceived value the product delivers. This is the optimal strategy for unique, innovative, or premium products with clear, defensible advantages.

Successfully implementing this model requires a deep understanding of your customer. What problem does your product solve? How much is that solution worth to them? This necessitates market research, customer feedback, and a clear articulation of your unique value proposition. To learn more, read our guide on how to implement value-based pricing.

Mini Use Case: A High-Performance Outerwear Brand A company develops a jacket with a proprietary fabric that is 50% lighter and more breathable than any competitor's product. Instead of using a cost-plus model, they price it based on the value it offers to serious hikers: superior comfort and performance. Even if the jacket costs only $10 more to produce, the perceived value might justify a $150 price premium over standard jackets.

Calculating Your True Cost of Goods Sold

A profitable pricing strategy is built on a precise understanding of your costs. Without a clear picture of every expense incurred to get a product into a customer's hands, you are operating without a reliable financial baseline. High revenue figures can obscure significant profitability issues if cost calculations are inaccurate.

Standard Cost of Goods Sold (COGS) is only the starting point. True profitability is revealed only when you account for all ancillary costs accumulated between the factory and the final sale.

Beyond the Factory Price: Landed Costs

A frequent point of failure is an incomplete calculation of landed cost. This is not merely the supplier's invoice price; it is the total cost of a product upon its arrival at your warehouse. Relying solely on the factory price is a critical error that ignores significant logistics and importation expenses.

To determine your true landed cost per unit, you must aggregate a range of expenses:

- Freight and Shipping: The cost to transport goods, which can fluctuate based on mode of transport and fuel surcharges.

- Insurance: The cost to protect inventory during transit.

- Customs and Tariffs: Duties, taxes, and fees levied on imported goods.

- Handling Fees: Port services, loading, and unloading fees often billed separately.

For example, an apparel brand imports jackets with a manufacturer cost of $45 per unit. Additional costs include $5 for sea freight, $1.50 for insurance, $4 in tariffs, and $0.50 for port handling per unit. The true landed cost is $56. Basing pricing on the initial $45 figure would have eroded the potential margin by over 24% before a single sale.

Factoring in Operational Overheads

Once goods are in your warehouse, additional costs accrue before a sale is made. These operational overheads are directly tied to marketing, selling, and fulfilling an order and must be allocated on a per-unit basis to accurately determine your break-even point.

Your break-even price is not your landed cost; it is the total cost required to acquire a customer and fulfill their order for a single unit. Omitting any component can turn a seemingly profitable sale into a loss.

These are unavoidable costs of doing business that must be factored into your pricing.

Key Overheads to Account For

- Marketplace and Seller Fees: Platforms like Amazon or eBay charge referral fees and commissions, typically 8% to 20% of the sale price.

- Payment Processing Fees: Payment processors take a percentage plus a flat fee (e.g., 2.9% + $0.30) on every transaction, directly reducing revenue.

- Marketing and Advertising Spend: Calculate your Customer Acquisition Cost (CAC) and allocate it per unit. If a $5,000 advertising campaign generates 500 sales, the marketing cost per unit is $10.

- Warehousing and Fulfillment: This includes storage costs, labor for picking and packing, and all packaging materials.

By meticulously tracking all landed and operational costs, you establish a true price floor—your absolute break-even point. Every cent above this floor contributes to gross profit. This detailed cost analysis is the non-negotiable first step in any sound pricing strategy.

Using Competitive Intelligence to Inform Pricing

Once you have a firm grasp of your costs and margins, the next step is to analyze the competitive landscape. In retail, your prices do not exist in a vacuum; they are constantly being compared by your customers.

This is not about blindly matching the lowest price, which inevitably leads to price wars and margin compression. The objective is to use competitor data to validate your pricing decisions, identify market opportunities, and understand your strategic position.

The pressure to get this right is significant. The Global Pricing Study 2025 by Simon-Kucher found that average price realization has fallen by 5 percentage points in two years to just 43%. With 22% of retailers citing intense competition as a primary challenge, market monitoring is no longer optional. Read the full research about these pricing challenges.

Who Are You Really Competing With?

First, identify your true competitors. These are the alternatives your target customers actively consider when making a purchase decision.

Your competitive set should include a mix of players:

- Direct Competitors: Businesses selling identical or highly similar products to the same audience.

- Indirect Competitors: Businesses solving the same customer problem with a different solution.

- Marketplace Sellers: Third-party sellers on platforms like Amazon or eBay who may be selling the exact same SKUs, often with aggressive pricing.

It's a Strategy, Not Just a Price

Knowing a competitor's price is insufficient; you must understand the strategy behind it. Analyze their pricing patterns to determine their market positioning—are they a premium, value, or budget-oriented brand?

This analysis reveals strategic gaps. For instance, if all key competitors are clustered at a low price point and rely on heavy promotions, it may signal an opportunity to launch a premium offering with a higher price justified by superior features, service, or brand positioning.

Competitive intelligence provides a map of your market. It shows you where the crowded battlegrounds are and, more importantly, where uncontested territory lies. The goal is to find spaces where your product's unique value can command a better price.

A Quick Guide to Strategic Choices

This matrix breaks down common pricing approaches to help align a strategy with your business goals.

Pricing Strategy Decision Matrix

| Strategy | Best For | Primary Goal | Key Challenge |

|---|---|---|---|

| Cost-Plus Pricing | Products with predictable costs and stable markets. | Ensure profitability on every sale by adding a fixed margin. | Can ignore market demand and competitor pricing, potentially leaving money on the table. |

| Competitive Pricing | Highly saturated markets with similar products (e.g., electronics). | Maintain market share by pricing in line with, or just below, competitors. | Risks triggering price wars and eroding margins if not managed carefully. |

| Value-Based Pricing | Unique, innovative products with clear differentiation. | Capture the maximum perceived value from the customer. | Requires a deep understanding of customer needs and the ability to communicate value effectively. |

| Dynamic Pricing | E-commerce, travel, and ride-sharing where demand fluctuates. | Maximize revenue by adjusting prices in real-time based on demand, time, or inventory. | Can be complex to implement and may alienate customers if it feels unfair. |

Choosing the right strategy is an ongoing process of evaluating your market, product, and customers to find the optimal balance between profitability and growth.

Track More Than Just the Price Tag

A competitor's price is a dynamic variable. Monitoring changes over time reveals insights into their business cadence and operational health.

- Promotional Cadence: Understanding when and how competitors run promotions allows you to plan your own campaigns proactively.

- Stock Availability: A competitor's out-of-stock situation is a direct opportunity. Monitoring inventory levels allows you to capture their frustrated customers, often at a full margin.

Manually tracking this data is not feasible; the information becomes obsolete almost immediately. This is where automated price monitoring tools like Market Edge become essential for providing the near real-time data required for timely and intelligent decision-making. For a deeper look, check out our guide on how to monitor competitor prices.

Keeping Your Brand's Pricing Consistent with MAP Policies

For manufacturers selling through retail partners, inconsistent pricing across channels can damage brand equity and create conflict with compliant retailers. A Minimum Advertised Price (MAP) policy is the primary tool to address this challenge.

A MAP policy is an agreement that dictates the lowest price for which a retailer can advertise your product. It is not price-fixing; rather, it establishes a level playing field, preventing a single discounter from devaluing your product for all other partners.

Why This Isn't Just Paperwork—It's About Your Bottom Line

Implementing and enforcing a MAP policy protects your brand's long-term health and profitability. Without it, you invite a "race to the bottom" where retailers erode margins to win sales, ultimately devaluing your product in the eyes of consumers.

A well-enforced policy achieves three key objectives:

- Protects Brand Equity: Consistent pricing reinforces a message of quality and value.

- Maintains Healthy Retailer Margins: Ensures partners can profit from selling your products, keeping them motivated.

- Avoids Channel Conflict: Prevents online sellers from consistently undercutting brick-and-mortar partners, preserving crucial relationships.

Putting Your Policy into Action

A MAP policy is only as effective as its enforcement. The primary challenge is monitoring every reseller on every marketplace, 24/7. Violations can appear and disappear quickly.

A MAP policy that is not enforced is worse than having no policy at all. It signals that the rules are merely suggestions, leading to widespread discounting and a loss of trust with your most valuable retail partners.

This is where automated monitoring tools are transformative. These systems act as your eyes and ears online, continuously scanning for prices that fall below your established minimum.

Mini Use Case: MAP Enforcement in Consumer Electronics A popular electronics brand discovered a third-party marketplace seller advertising its flagship headphones at 15% below MAP. Major retail partners immediately complained about being unfairly undercut. Using an automated price monitoring solution, the brand was able to act decisively.

- The platform instantly identified the violator, capturing timestamped screenshots as irrefutable proof.

- With a clear, documented record of the violation, the brand initiated its standard enforcement protocol.

- A formal notice was sent to the seller, who promptly corrected the advertised price.

By detecting the violation in hours instead of weeks, the brand quickly resolved the issue, restored fairness in the channel, and demonstrated to all partners that its MAP policy was rigorously enforced. To learn more, read about what Minimum Advertised Price is and how these policies function.

This is precisely where a tool like Market Edge becomes useful, providing the real-time data and documentation needed to make MAP enforcement a manageable and effective component of your channel strategy.

Your Actionable Retail Pricing Checklist

This checklist translates pricing theory into an actionable framework for setting or reviewing prices. Use these checkpoints to ensure no critical step is missed.

Foundational Analysis

This stage is about understanding your internal numbers and your external market environment.

-

Calculate True Costs: Determine your all-in costs, including freight, duties, marketplace fees, and payment processing. This establishes your absolute price floor.

-

Set Clear Target Margin: Based on your true cost, define the gross profit margin required for each product to meet financial goals.

-

Map the Competition: Identify direct and indirect competitors and analyze their market positioning. This context is crucial for determining where your own products should be positioned.

A pricing strategy without a solid grasp of your costs and the competitive landscape is merely a guess. This foundation prevents reactive, margin-eroding decisions.

Strategy and Execution

With the foundational analysis complete, you can build and implement your strategy.

-

Select Core Pricing Model: Choose your primary approach: cost-plus for simplicity, competitor-based for market alignment, or value-based for unique offerings. This choice anchors your pricing logic.

-

Establish a Monitoring System: Implement a system, whether manual or automated, to track key competitor SKUs, promotions, and stock levels. Continuous intelligence gathering is non-negotiable in today's market.

-

Schedule Regular Price Reviews: Pricing is not a one-time task. Schedule formal reviews—quarterly at a minimum, though monthly is preferable for dynamic markets—to analyze data and ensure your prices remain optimal.

This last point is where automated tools like Market Edge provide significant value by performing the heavy lifting of market tracking.

Common Questions We Hear About Retail Pricing

Once the fundamentals are in place, practical questions arise. Applying pricing theory in daily operations is where many managers, founders, and e-commerce leaders face challenges. Here are answers to common questions about timing, terminology, and unique product scenarios.

How Often Should I Actually Be Reviewing My Prices?

The ideal frequency depends on market velocity. In fast-moving e-commerce environments, failing to monitor prices continuously means leaving money on the table.

- E-commerce & Marketplaces: Use tools to scan competitor prices daily. Be prepared to make adjustments at least weekly based on market changes and internal inventory levels.

- More Stable Retail Categories: In less volatile sectors, a quarterly review is the absolute minimum to ensure your strategy remains aligned with market conditions.

The most significant shift among successful retailers is the move from static annual price lists to a dynamic review cycle. This is the single most effective way to prevent margin leakage and capitalize on new opportunities.

Can You Explain the Difference Between Markup and Margin Again?

Yes. While both measure profitability, they do so from different perspectives. Understanding the distinction is critical for financial accuracy.

Markup is the amount you increase the price from the cost. Margin is the percentage of the final selling price that is profit.

| Metric | The Question It Answers | Formula Example |

|---|---|---|

| Markup | "How much did I increase the price from my cost?" | (Selling Price − Cost) ÷ Cost |

| Margin | "What percentage of the final selling price is profit?" | (Selling Price − Cost) ÷ Selling Price |

For a product purchased at $100 and sold for $150, the markup is 50%, but the profit margin is 33%. Knowing both figures ensures your pricing is sustainable.

How Do I Price a Product That Has No Direct Competitors?

In the absence of direct competitors, you must pivot to value-based pricing. This approach focuses on the value your product delivers to the customer, not on market comparisons. The objective is to price based on the outcome you provide.

- Conduct Customer Research: Use surveys and focus groups to understand what customers believe is a fair price and what value they derive from your solution.

- Identify the Next-Best Alternative: Analyze what customers are using now. Even an indirect competitor provides a price anchor.

- Quantify the Value: If your product saves time or increases revenue, assign a monetary value to that benefit. A tool that reduces a 10-hour weekly task to one hour has a clear, tangible value that can inform its price.

Pricing a unique product is not about what the market will bear; it's about confidently charging what your solution is worth.

Answering these common questions is a great start, but those answers become far more powerful when you can back them up with real-time data.

Immediate Actionable Takeaways

- Synchronize Price Reviews: Align your price review schedule with your promotional calendar and key sales cycles.

- Document Financial Targets: Formally document the target markup and margin for every product category.

- Pilot a Value-Based Model: Select a small customer segment and run a test using a value-based pricing approach for a new or unique product.

This is where automated price monitoring tools like Market Edge become useful, providing the live data you need to execute these strategies effectively.