On Amazon, price is not just a number—it is a primary lever for winning sales, protecting brand value, and driving profitability. The right Amazon pricing strategies determine Buy Box ownership, inventory velocity, and how customers perceive your brand. Without a deliberate plan, sellers often fall into a race to the bottom that erodes margins and damages market standing.

Why Your Pricing Strategy Defines Your Amazon Success

Reactive or manual pricing is one of the fastest ways to lose ground on Amazon. It leads to margin compression, lost sales to more agile competitors, and long-term damage to brand equity. Conversely, a proactive, data-informed strategy transforms pricing from a defensive necessity into a competitive advantage, enabling you to grow market share and profitability simultaneously.

This guide moves beyond theory to detail the essential Amazon pricing strategies B2B decision-makers can implement to achieve specific commercial goals—from capturing the Buy Box with dynamic repricing to defending brand integrity through MAP policy enforcement.

The Commercial Impact of Strategic Pricing

Every pricing decision creates a ripple effect across your Amazon operations. An intelligent strategy is not about being the cheapest; it is about being the most informed. The commercial stakes are high, with a thoughtful approach impacting several critical areas:

- Buy Box Ownership: Price is a heavily weighted factor in Amazon's Buy Box algorithm. A competitive price, combined with strong seller metrics, significantly increases the probability of winning the sale. Since over 80% of Amazon sales occur through the Buy Box, it is the single most important objective on the platform.

- Profit Margin Protection: An effective strategy begins with establishing non-negotiable price floors based on your true cost of goods, fees, and desired margin. This acts as a safety net, preventing automated repricers from entering unprofitable price wars.

- Brand Perception and Value: For manufacturers and premium brands, pricing consistency is critical to protecting brand perception. When third-party sellers violate pricing policies, it can devalue the brand and strain relationships with authorized retail partners. A clear use case for competitor tracking is identifying these unauthorized sellers quickly.

- Inventory Velocity: Strategic pricing is also a key tool for inventory management. Promotional pricing can be used to liquidate aging stock, while premium pricing can maximize returns on high-demand products.

A common mistake is viewing pricing in a vacuum. On Amazon, price is deeply intertwined with inventory levels, seller reputation, and fulfillment method. A winning strategy integrates all these variables to make informed, profitable decisions.

Ultimately, mastering your pricing strategy is about taking control. Instead of reacting to competitor moves, you can set the market pace, protect your bottom line, and build a sustainable business. This is where automated price monitoring tools like Market Edge become useful.

Choosing the Right Pricing Model for Your Goals

There is no single “best” pricing strategy on Amazon. The optimal approach is a direct reflection of your product, competitive landscape, and business objectives. Matching the model to your business is the first step toward building a resilient and profitable pricing framework.

For example, a high-volume distributor managing thousands of SKUs has different priorities than a premium electronics brand. The distributor will likely rely on automated repricing to win the Buy Box at scale. The brand, however, must prioritize brand equity with rigorous MAP enforcement, a process that requires diligent marketplace monitoring.

Dynamic and Competitive Pricing Models

In fast-moving, crowded markets, dynamic pricing is the standard. Typically executed by an automated repricer, its purpose is to make frequent, small price adjustments to capture the Buy Box without unnecessarily sacrificing profit. This model is essential for resellers and distributors of products where price is a primary purchasing driver.

A competitive pricing model is a more targeted variation. Instead of reacting to the current Buy Box holder, you strategically position your price against specific competitors. For instance, a rule might be set to always be $0.01 below the lowest FBA seller or 2% higher than a seller with poor reviews to signal superior value.

To execute either model effectively, continuous market monitoring is non-negotiable. Amazon’s own algorithms are notoriously aggressive, adjusting prices as often as every 10 minutes. Manually keeping pace is impossible. For a deeper look, you can discover more about Amazon's historical pricing data to understand the complexity.

Value-Based Pricing and MAP Enforcement

Value-based pricing is the antithesis of a race to the bottom. This strategy is for brands with products that offer unique features, superior quality, or a strong reputation. The goal is not to match the lowest price but to set a price based on the perceived value to the customer. This requires a compelling product listing, high-quality A+ Content, and strong social proof (reviews) to justify the premium.

Key Insight: Many Amazon shoppers correlate a higher price with better quality. If your product page, branding, and reviews effectively communicate a premium offering, you can command a higher price and improve margins.

Minimum Advertised Price (MAP) enforcement is less a pricing strategy and more a brand protection imperative. For manufacturers, it is essential for maintaining channel harmony and brand value. When unauthorized sellers list products below your MAP, it erodes your brand’s image and creates conflict with authorized retailers who adhere to the policy.

The objective is not to set a price but to enforce a policy. This requires a systematic process:

- Establish a clear, legally sound MAP policy.

- Monitor all online channels for violations. This is a core function of ecommerce and marketplace monitoring.

- Document every violation with time-stamped evidence.

- Enforce the policy consistently through an automated warning and escalation workflow.

This process is a prime example of where automated competitor tracking becomes indispensable. Platforms like Market Edge can monitor marketplaces for your products 24/7, automatically flagging any seller whose advertised price falls below your MAP threshold.

Comparing Key Amazon Pricing Strategies

Choosing the right strategy starts with clearly defined goals. A distributor of commodity office supplies requires a different plan than a manufacturer of high-end audio equipment. The key is to align your pricing model with your business model.

This table provides a side-by-side comparison of the primary Amazon pricing strategies to aid in selection.

| Strategy | Primary Goal | Best For | Key Challenge |

|---|---|---|---|

| Dynamic Pricing | Win the Buy Box, maximize sales velocity | High-volume sellers, resellers of popular goods | Margin erosion if price floors are not set carefully |

| Competitive Pricing | Gain market share from specific rivals | Challengers in established markets | Can lead to direct price wars if not managed |

| Value-Based Pricing | Maximize profit margin, build brand equity | Unique products, premium brands, private labels | Requires strong branding and social proof to justify |

| MAP Enforcement | Protect brand value and retail partnerships | Manufacturers, brand owners with reseller networks | Requires consistent, diligent monitoring and follow-up |

The most effective Amazon pricing strategies are often hybrid and adaptable. You might use dynamic pricing for a legacy product line, a value-based approach for a new premium launch, and MAP enforcement across your entire catalog. Success depends on having the data and tools to execute each strategy effectively.

How to Make Automated Repricing Actually Work for You

Implementing dynamic pricing is not a "set it and forget it" task. While many sellers view it as letting an algorithm take over, successful operators know it is a disciplined strategy built on clear, predefined rules. When configured correctly, an automated system executes your pricing decisions with perfect consistency, 24/7, but its success hinges on establishing the right guardrails.

Without these guardrails, automated repricing can quickly devolve into a race to the bottom that destroys profits and harms brand perception.

The foundation of any repricing strategy is defining your price floor and price ceiling. Your floor is the absolute lowest price that covers your cost of goods, Amazon fees, shipping, and a minimum acceptable profit. Your ceiling is the maximum price, typically determined by MAP policies or market tolerance.

These boundaries are non-negotiable. They prevent a repricer from selling at a loss during a price war and from setting a price so high that it becomes uncompetitive. They are the financial controls that ensure automation works for you, not against you.

Creating Your Core Repricing Rules

Once your financial safety net is in place, you must define the rules that trigger price changes. These rules should directly reflect the business goals for each product. Avoid using a single generic rule for your entire catalog; the most successful sellers apply a mix of rules that respond to competitor actions and market dynamics.

Here are a few practical, rule-based examples:

- Match the Buy Box Price: A straightforward rule designed to maintain competitiveness and secure a share of Buy Box rotations. Ideal for fast-moving products where sales velocity is the primary goal.

- Stay $0.01 Below the Lowest FBA Offer: A more aggressive tactic that specifically targets other FBA sellers to gain a pricing advantage. As fulfillment method is a major Buy Box factor, this can be highly effective. Our guide on how to win the Buy Box on Amazon provides more detail on this tactic.

- Price Against a Specific Competitor: If you have a primary rival, you can set a rule to always maintain a specific price position relative to them (e.g., 2% below or 1% above). This allows you to strategically position your product as either the value or premium option.

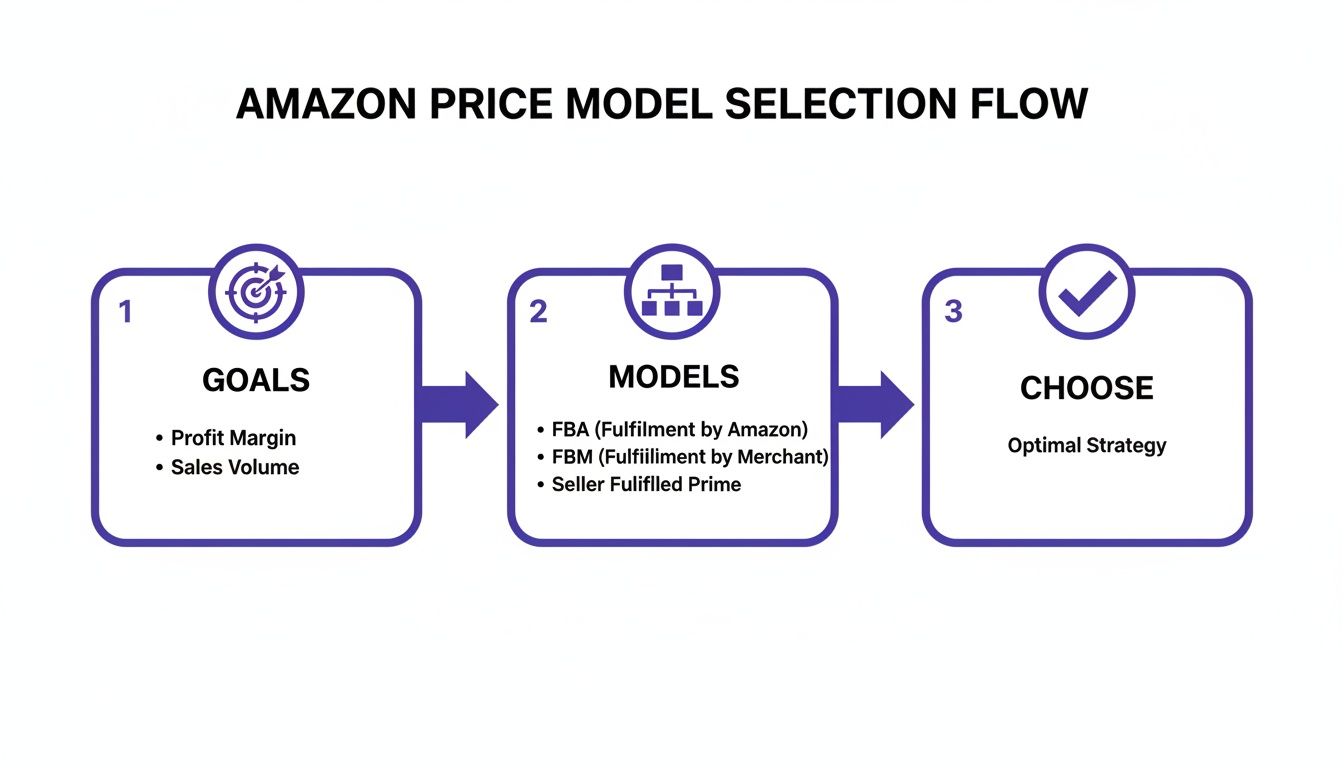

This flowchart illustrates the process of moving from high-level goals to a specific, actionable pricing model.

As shown, a successful strategy always begins with a clear objective. That goal dictates the appropriate pricing model, which in turn informs the rules for implementation.

Advanced Rules Using Stock Levels

A trigger that many sellers overlook is competitor inventory levels. When a direct competitor's stock is low, it creates a significant opportunity. An intelligent repricer can be programmed to recognize this signal and execute more advanced, profit-driven rules.

Real-World Example: Your main competitor holds the Buy Box for a popular consumer electronic, but price monitoring shows their stock is nearly depleted. An intelligent repricing rule can be set to automatically increase your price by 5%. This allows you to capitalize on their vulnerability, capture sales from motivated buyers at a higher margin, and potentially still win the Buy Box.

Attempting this manually across hundreds of SKUs is not feasible. It requires constant, accurate data on competitor actions. By reacting to a rival's low inventory, you can shift from a defensive to an offensive posture, maximizing profit when the market presents an opening.

This is where automated monitoring tools like Market Edge prove their value. They supply the clean, real-time data on competitor prices and stock levels needed to power these smarter rules, preventing costly errors and ensuring your repricer acts on current market conditions.

Protecting Your Brand with MAP Enforcement

So far, we have focused on pricing strategies designed to win individual sales. For brand owners and manufacturers, however, another layer is crucial: MAP (Minimum Advertised Price) enforcement. For a brand, uncontrolled online pricing is not just a nuisance; it is a direct threat to brand equity, retail partner relationships, and long-term viability.

When third-party resellers ignore your MAP policy, it triggers a domino effect. First, the brand's perceived value declines, undermining marketing investments. More critically, it penalizes authorized partners—especially brick-and-mortar retailers—who cannot compete with constant online undercutting.

Consider a premium consumer goods brand with a network of dedicated retail partners. If those partners see the brand’s products sold on Amazon for 20% below MAP, their confidence in the partnership erodes. They will reduce promotional support and may eventually drop the product line. This is the real-world commercial risk of lax MAP enforcement.

The Commercial Case for MAP Monitoring

Failure to enforce a MAP policy is a significant business risk that can unravel a distribution network. It signals to the market that your brand’s value is negotiable, inviting a price war that benefits only unauthorized discounters.

Protecting your brand demands a proactive and consistent approach. The policy must be non-negotiable and enforced uniformly across all channels. If you are new to this concept, it is worth understanding what a Minimum Advertised Price policy entails and how to construct one that is legally defensible.

An Actionable Workflow for MAP Enforcement

Implementing a MAP enforcement program can be straightforward with a repeatable workflow. This transforms a reactive problem into a structured system for brand protection.

Here is a four-step workflow you can implement immediately:

- Establish a Clear Policy: Your MAP policy must be unambiguous, legally sound, and distributed to all retail partners. It should clearly state the minimum advertised prices for each SKU and the consequences for violations.

- Continuously Track Resellers: Manual price checks are inefficient and prone to error. You need an automated system that continuously scans Amazon and other marketplaces for sellers advertising below your MAP.

- Document Every Violation: When a violation is detected, you need objective proof. This includes time-stamped screenshots showing the product, seller name, and the advertised price that violates the policy.

- Automate Violation Notifications: With documented evidence, the enforcement process begins. This typically starts with an automated notification to the seller, informing them of the violation and requesting compliance.

The Role of Automation in Protecting Your Brand

The scale and speed of ecommerce render manual MAP monitoring impractical. Amazon itself uses sophisticated logic to adjust prices, with millions of changes occurring daily. You cannot fight an algorithm with a spreadsheet.

A strong MAP policy is only as good as your ability to enforce it consistently. Sporadic enforcement creates confusion and resentment among your retail partners, undermining the very trust you're trying to build.

This is where automated competitor tracking tools become a central command for brand protection. A solution like Market Edge automates the tedious work of detection and documentation. It scans marketplaces 24/7, flags MAP violations as they occur, and collects the necessary evidence. It transforms a manual, error-prone task into an efficient, scalable system that preserves brand value and maintains healthy retail channels.

Using Historical Data for Smarter Decisions

Reacting to current market conditions is only half the battle. An effective Amazon pricing strategy must also leverage historical data to anticipate future trends. Think of historical price data as the long-term context that allows you to shift from reactive price changes to strategic, profit-driven decisions.

Without this historical view, you operate with a significant blind spot. You might see a competitor drop their price and feel compelled to match, but you lack the context to understand why. Was it a clearance sale? A response to a new competitor? Or part of a predictable restocking cycle?

Collecting and analyzing historical data provides a distinct competitive advantage. It helps you build forward-looking strategies instead of reacting to daily market noise.

Uncovering Competitor Patterns and Cycles

By consistently tracking competitor prices over weeks and months, you can identify patterns that are invisible in day-to-day analysis. This historical log reveals trends that inform more strategic actions.

- Restocking Cycles: Many sellers adjust prices based on inventory levels. If a key competitor suddenly drops their price, it could signal an incoming shipment. Recognizing this pattern allows you to hold your price steady, avoiding an unnecessary margin sacrifice.

- Seasonal Demand Peaks: By analyzing price data from the previous year, you can pinpoint when demand for a product begins to rise. This enables you to time promotions or gradually increase prices to maximize profit during peak season.

- Price Elasticity: Historical data is the most effective way to measure how sales volume responds to price changes over time. It helps you understand a product's true price elasticity, providing the confidence to launch a new item at a higher price or hold firm when competitors initiate a price war.

Real-World Use Case: A brand plans to launch a new line of seasonal outdoor equipment. By analyzing the last 18 months of pricing data for comparable products, they discover that prices consistently increase by 15-20% between April and June. Armed with this insight, they set a higher launch price in March, maximizing profitability from day one.

Building a Forward-Looking Strategy

Amazon is a master of this approach, constantly analyzing historical data to forecast trends and refine its own strategies. You can apply the same playbook. Benchmarking against competitors reveals recurring patterns, such as predictable price wars in electronics or stable seasonal pricing in other categories. For more on this, you can discover more insights about Amazon's data-driven pricing on metricscart.com.

The goal is to use this data not just for retrospective analysis but to build a predictive model for your own pricing. Knowing how competitors behaved last quarter provides a strong indication of how they will act next quarter. This insight is what separates basic repricing from a truly strategic approach. For a breakdown of the platforms that enable this, our guide on competitor price monitoring software explains how these tools operate.

This is precisely where automated price monitoring tools like Market Edge are valuable. They perform the heavy lifting of systematically collecting and organizing historical data, presenting it in a format that makes it easy to spot trends and build a more intelligent, forward-looking strategy.

Your Actionable Amazon Pricing Checklist

Implementing a robust pricing strategy should be a structured process, not a complex one. This checklist serves as a roadmap, breaking down the effort into clear, repeatable steps that guide you from initial planning to profitable execution.

Phase 1: Audit and Analysis (The Foundation)

Before making any price changes, establish a baseline. This phase is about understanding your current position and defining success.

- Define Commercial Goals per Product Line: What is the primary objective? Maximize sales velocity? Protect brand perception? Optimize gross margin? Assign a clear goal to each key product category.

- Identify Key Competitors: Pinpoint the top 3-5 direct competitors for your most important ASINs. Begin tracking not only their prices but also their stock levels and seller ratings.

- Calculate True Costs: Determine your complete cost of goods sold (COGS), including all Amazon fees, shipping, and overhead, to establish a profitable baseline.

Phase 2: Strategy and Rule Definition (The Guardrails)

With your goals defined, select your tactics and establish the rules of engagement that will protect your business from costly errors.

- Assign a Primary Pricing Model: Match a specific pricing model (Dynamic, Value-Based, etc.) to each product category based on your defined goals.

- Set Price Floors and Ceilings: For every SKU, establish a non-negotiable minimum price (floor) and a maximum realistic price (ceiling). This is the most critical step in preventing margin erosion from automated tools.

- Draft Core Repricing Rules: Based on your chosen models, write specific rules. For example: "For SKU X, stay $0.01 below the lowest FBA offer, but never go below my floor price of $24.50."

Phase 3: Technology and Monitoring (The Execution)

In a market where prices change constantly, manual execution is not viable. The right technology is a necessity for effective implementation.

- Implement Price Monitoring Automation: To power any strategy, you need clean, real-time market data. This is where you deploy automated price monitoring tools like Market Edge to gather the necessary intelligence.

- Configure Your Repricer: Feed the rules and price boundaries from Phase 2 into your repricing software. Ensure it is configured to act on the data provided by your monitoring tool.

- Track Key Performance Indicators (KPIs): Monitor your Buy Box win rate, gross margin per SKU, unit session percentage (conversion rate), and average selling price (ASP) to measure the impact of your strategy.

- Schedule Quarterly Reviews: A strategy is never "set it and forget it." Establish a recurring quarterly meeting to review performance against KPIs and make data-driven adjustments.

Your Top Amazon Pricing Questions, Answered

If you’re selling on Amazon, you’ve probably got questions. The marketplace can feel like a maze, and pricing is often the most confusing part. Let's tackle some of the most common questions we hear from sellers to help you build a smarter, more profitable strategy.

How Often Should I Change My Prices on Amazon?

The optimal frequency depends entirely on your strategy and product category. There is no one-size-fits-all answer.

For a reseller in a highly competitive category aiming for Buy Box ownership, prices may need to change multiple times per day. For a private label brand with a unique product, a "set and monitor" approach with infrequent, data-informed adjustments is often more effective. The guiding principle is to ensure every price change is purposeful and aligned with a specific business goal.

Can I Compete on Amazon Without Being the Cheapest?

Yes, absolutely. A common misconception is that winning on Amazon requires being the lowest-priced seller. While price is a significant factor in the Buy Box algorithm, it is not the only one.

Amazon prioritizes the overall customer experience. Other heavily weighted factors include:

- Fulfillment Method: Fulfilled by Amazon (FBA) offers have a distinct advantage over Fulfilled by Merchant (FBM).

- Seller Rating: Positive feedback is a direct measure of trustworthiness.

- Shipping Speed: Faster delivery times are always preferred.

- Inventory Availability: You cannot win the Buy Box if your product is not in stock.

A slightly higher-priced FBA offer from a seller with a 99% rating will consistently beat a cheaper FBM offer from a seller with a 92% rating. This demonstrates that value is determined by the complete offer, not just the price.

What Is the Difference Between a Repricer and a Price Monitoring Tool?

This is a critical distinction, and confusing the two can lead to costly mistakes.

A repricer is an execution tool. It is the software that automatically changes your product prices on Amazon based on the rules you have set.

A price monitoring tool is an intelligence-gathering platform. It is the system that provides the essential data—such as competitor pricing, stock levels, and historical trends—needed to create effective rules.

A repricer without accurate, real-time data is just guessing, but faster. It’s the market intelligence from a monitoring tool that transforms a repricer from a potential liability into a strategic, profit-driving asset.

This is precisely where a platform like Market Edge comes in. It provides the clean, reliable data your repricer needs to make consistently smart, profitable decisions.

A winning pricing strategy is built on a foundation of accurate, real-time market intelligence. Market Edge delivers the competitor price and stock data you need to set smarter prices, enforce MAP, and win more sales. Find out how you can protect your margins at https://marketedgemonitoring.com.